If you are a rookie trader, selecting the best Forex trading platform can become troublesome. Factually, choosing the most suitable, easy to access, and intuitive platform directly affects the trading strategy and potential profit of the traders.

Surprisingly, the majority of the top-notch and popular Forex brokers have established their proprietary platforms. However, these brokers offer several different options to meet the preferences of the investors.

The top-class and widely used trading platforms include cTrader, MetaTrader 4, and ZuluTrade. The following article will tell everything, including the pros and cons of the former three, known as some of the top-notch Forex trading platforms for the beginners in trading.

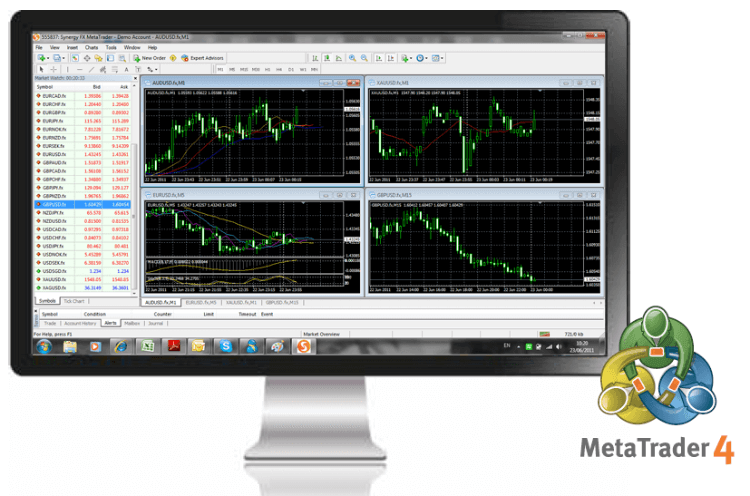

MetaTrader 4 Platform Overview

Most of the forex brokers and forex traders have been using MetaTrader 4 since 2005. It would not be wrong to call it the gold standard forex trading platform.

MetaTrader 4 allows its customers to analyze the market, perform technical analysis, identify trading signals, and schedule automatic trading to not miss out on any opportunity to make investments.

MT4 has gained popularity among beginners due to its easy-to-use interface and free educational information available online for the users

Metatrader 4 (MT4) Review

The UI of the MetaTrader 4 platform is the simplest. All the new FX traders can learn how to trade on the platform within five minutes only!

The platform comes with built-in oscillators, price charts, and indicators for all the FX traders. The traders can quickly select them by right-clicking on the features. Factually, the wide variety of technical tools covers almost all trading strategies. Also, to find them easily, they are arranged in alphabetical order.

Moreover, the trading buttons on MT4 are simple to use, having permanent (buying/selling) price quotes updates during the working hours of the market. All the FX traders have full control of the placement of orders. Note that the only limitations on the traders are by Forex brokers.

Metatrader 4 Pros and Benefits

Mostly all the forex brokers around the world use the famous MetaTrader 4 platform. Otherwise, get supporting bridging apps that they integrate into their trading platform’s software

You can download the platform for free from the Metaquote software website or the official forex broker website. Also, it is fully functional on different Mac and Personal computers.

Surprisingly, MT4 has a completely integrated platform. The platform comes with popular and widely adopted forex oscillators and indicators that can be removed and added to different price charts within seconds. You can download more indicators (free and paid) from the Metaquote’s website.

The top forex traders offer a large amount of costless trading teaching materials so that you learn the fundamentals of forex trading and also improve your trading strategy.

The traders can get access to numerous educational tools in the form of tutorials, videos, and explanatory text online. Using these educational tools, beginner traders can learn how to use MT4 and implement their trading strategies while trading.

The software is customizable. Additionally, the FX traders can choose their trading signals, price charts, currency pairs, markets, expiration time, etc.

Furthermore, MT4 allows the creation of custom indicators and technical, analytical tools by any trader.

You can install the MT4 application from any iOS or Android compatible devices to watch out the market and place orders even on the move.

Using the SMS and email alert service, you will keep up with all the price signals and price momentum. After the feature activation, you will be receiving email and SMS on your mobile phone every time there is a movement towards the preset or at the preset value in the market.

The alert feature is the best for the traders as it will notify them, preventing unexpected price movements that affect their strategy.

With the help of the displays, the traders can view four different price charts at one time and lets them trade on each one of them independently.

Copy trading is another fantastic option for beginner traders. Using it, the new traders can see how the advanced traders are trading, investing, and generating profits through Forex trading. Once the traders analyze any of the best traders, they can copy their trades, market moves and make use of their strategy depending upon their investments and preset trading conditions.

cTrader Overview

cTrader was launched in April 2016 and is developed by Spotware.inc.

People consider the platform as a third-generation trading platform that was specifically designed for delivering the enormous amount of Forex market data to the traders within seconds. This way, they could enable a quick market entry and order execution.

Furthermore, cTrader’s developers also kept in mind the mobility capacity and efficiency required by the forex traders globally. They developed a charting market data delivery system that speeds up the placement of the orders through virtually no waiting time to get rid of variation in the Forex market.

cTrader Platform Review

The cTrader trading platform is incredibly intuitive and straightforward to use, just like you would expect from a post MT4 software development. Overall, the platform simplifies the trading process for both the FX brokers and traders.

The displays were designed while keeping the trader’s needs in mind, and they can easily customize them. It offers excellent modern charting tools and has all the technical tools the traders require for implementing trading strategies.

The large amounts of information from the financial markets are combined to improve the risk management plan of the traders. Also, this will assist them in adhering to their trading or investment strategies.

cTrader Pros and Benefits

Well, cTrader is a web-based trading platform that allows the users to convert any internet-connected compatible computer into a modern trading station. Once the traders log in their trading account, they can quickly get and manage their accounts from anywhere.

The platform has an efficient data delivery system and charting tools that allow fast delivery of information. Hence, the traders get to make better, smarter, and quicker forex trading investment decisions.

Thanks to the speedy order placement that the FX traders can now fill and place their orders within less than a second. Besides, please note that there isn’t a limitation on the number of consecutive orders using the no order queue feature of the software.

Moreover, cTrader depicts the Volume Weighted Average Price (VWAP). It is a second level price sub-system that helps you know the current range of executable prices, disclosing the recorded transactions of the order book.

The traders can pick their trigger methods for “Take Profits” and “Stop Losses,” reducing the chances of financial losses and adverse outcomes from the erroneous market signals interpretations.

The quick trade feature is just like one-click trades that enable the traders to open, close, and modify positions within seconds whenever the market comes across high volatility or rushing.

Using the cTrader Tooltips, the commission, cost, margin required, pips of your current order volume, and the current value is informed while centralizing within one window the trading conditions for every instrument of forex investment.

The symbol data provides the lot sizes, market hours, and critical information for the forex instruments.

The cTrader Market Sentiment is a modern real-time indicator of the percentages of traders in different supported forex brokers that presume the exchange rate for a specific currency pair to rise or fall. Using the market sentiment, you will get an insight into the forex traders’ expected price moving direction of different exchange rates and how they are making investments.

With the help of the email alerts, the traders get an insight of the currency market and remain informed when any market condition or preset is met. These alerts help reduce the response time, increasing the potential to generate profit.

cTrader Copy let’s all the traders copy the investment strategy from fx traders.

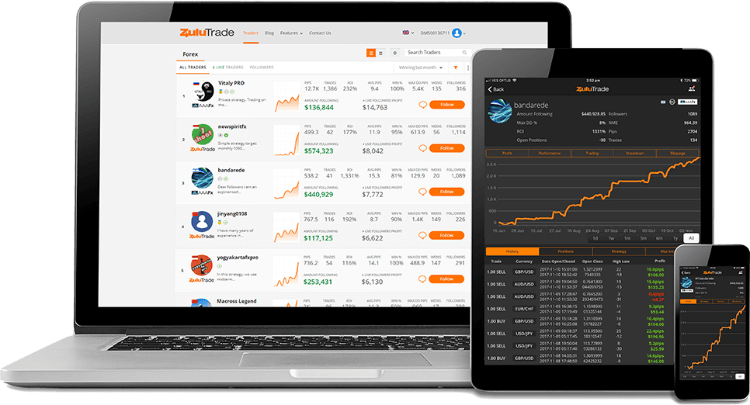

ZuluTrade Overview

ZuluTrade came out in 2007 after a new era of social networking. The main feature of the platform is the establishment of the social trading concept.

Through social trading, users can see and copy what the other traders are doing and make investments. The FX traders can imitate the whole trading strategy or a part of the trading strategy of the professional Forex traders.

The chances of copying from expert Forex traders might increase the chances of winning and generating revenue for the new traders. In short, the feature is designed as the best financial advice and trading tip any trader could get making ZuluTrade one of the top forex trading platforms for new traders.

ZuluTrade Platform Review

The ZuluTrade platform is simple to use. Therefore, any new user can quickly learn how to see what other experienced forex traders are doing, how they are investing their funds, and what revenue do they get from forex trading.

The user interface is simple and straightforward. The users can choose to start or stop following and imitate someone else’s strategy free of charge. Furthermore, the traders can live chat with other traders and exchange each other’s trading strategies. They even have the option to exit from the chat rooms and other forums.

ZuluTrade Pros and Benefits

The traders are divided into two categories:

Followers – New traders that copy the trading of professional traders.

Signal Providers – Experienced and professional traders that are willing to share their strategy and forex market knowledge with the beginners. The signal providers are rated based on their overall profits, the success of the trading strategy, and the winning rate.

ZuluGuard is a stop copy feature. So this feature helps to stop the following and copying any signals provider that makes changes in his/her trading strategy.

ZuluScript is an automatic trading software programmed to automatically copy from a signal provider and place orders when the preset values are met. The preset trading criteria can be customized entirely and will vary on the choices, preferences, and strategy of the FX trader.

The beginners can imitate the whole portfolio or any part of it. Moreover, once the followers learn the way of the signal providers, they can place the orders manually.

Social trading is always corresponding; the ZuluTrade algorithm maintains a percentage just like the followers.