In our Admiral Markets UK review, we will discuss one of the dominating trading services suppliers that provide trading investment services, including Forex and CFDs.

Throughout this Admiral Markets UK review, you will learn much about the organization and acquire better information about investing in this platform. Let’s begin our tour toward a valuable investment.

What is Admiral Markets UK? – Organization Presented

Operating under the Admiral Markets trademark, Admiral Markets is an investment organization offering investment services for trade with CFDs and Forex, indices, currencies, bonds, energies, and precious metals. Founded in 2011, the organization has never stopped expanding since then.

Today, it offers its services globally via its regulated trading firms. Admiral Markets Group aims to give traders access to fully-functional software that ensures a precise and quality trade experience.

The organization’s investment firms possess a brilliant reputation and provide excellent services, high investment security, and financial stability.

Facts Regarding Admiral Markets:

- It was established in 2011, and they are licensed and regulated.

- Provides investment services with Forex and CFDs.

- Provides services all over the world (via its regulated firms).

- Provides client support in various languages.

Is Admiral Markets UK Regulated? – Regulation and Security for Clients

Before any investment, you must ensure that you invest in licensed and regulated organizations. Several fraudulent organizations are roaming around the internet nowadays.

These organizations are not regulated, so you should be careful about that. Regulation by an official authority is significant since it protects you from online fraud. You should also ensure the organization possesses a license since it proves the dealer is reliable and has met some required criteria and regulations.

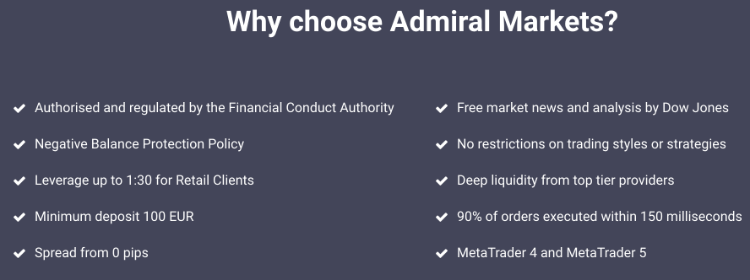

Admiral Markets UK is regulated and authorized in Australia and Europe. Its brilliant reputation ensures that its firms have reliable platforms and provide quality services and high investment protection.

The following regulate Admiral Markets:

- ASIC (Australia)

- EFSA (EU – Registered in Estonia)

- FCA (UK – Registered in Wales and England)

- CySEC (EU – Registered in Cyprus)

Financial Safety

Client funds are kept in separate bank accounts by Admiral Markets, and the organization doesn’t utilize client funds for its investments or any other reason. Moreover, the dealer is verified and authenticated by popular auditors.

Also, there’s FSCS (also called the Financial Service Compensation Scheme). It implies that if the bank (where the money is kept) goes bankrupt, it provides a security fund of up to 85,000 pounds.

One more significant point to consider is the negative balance of security. Therefore, you’re secure since the dealer provides 50,000 pounds per customer.

Summary of financial protection and regulation:

- Separate client funds.

- Negative balance security up to 50,000 pounds.

- Multi-regulated online dealer.

- FSCS up to 85,000 pounds.

Trading Conditions’ Review

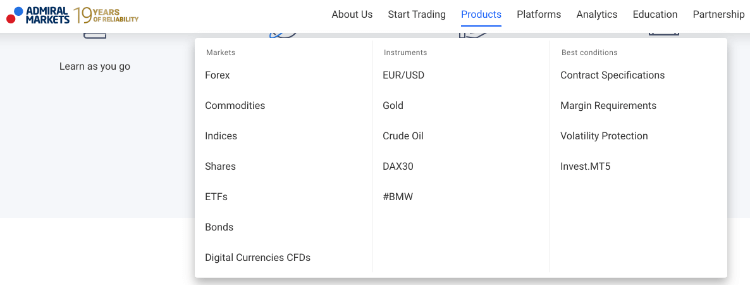

Admiral Markets allow you to trade with CFDs and Forex on cryptocurrencies, stocks, bonds, crude oil, energies, and Indices. The trader can select from 70 Foreign Exchange pairs as valuable as metals. It’s a worldwide Forex dealer aiming to make online Forex trading available for traders and clear for individual currency traders worldwide.

It’s a proven trading platform that is beneficial and efficient. The instruments offer an excellent and detailed understanding of the markets, which significantly helps the trader.

Admiral Markets has demonstrated its performance and has been regarded as the top Forex dealer by the users of its online dealer portal, portal.de (readers’ choice). In 2015, the organization was granted 2nd place in the “Forex Dealer of the Year” category by Broker Wahl (Germany Brokerwahl).

Admiral Markets offers three account types: “Admiral. Prime,” “Admiral. Markets,” and “Admiral.MT5“. Every account has distinct conditions and asset classes to choose from. Every account offers different leverages, some of which charge a commission or a fee.

The maximum leverage is 1:500, and spreads are not continuous and start from 0.0 pips based on the market requirements and type of account.

Admiral Markets also facilitates the users through many training and educational schemes. It aids the users in making well-informed decisions while trading. The organization also offers webinars and seminars that assist in developing essential trading skills, providing risk awareness, and educating users in the Forex market.

An excellent characteristic of Admiral Markets is that it provides fundamental and technical analysis daily, which is a plus point for traders. Also, an economic calendar with worldwide currency rates is available on the Admiral Markets’ website.

It also has partner Portals, allowing users to access their page with commission, progress, and profit updates. The dealers are reliable, regulated, and well-known. The organization and its dealers have been operating for 18 years of trust and have proven their value to the users.

Facts about trader conditions:

- Three different types of accounts.

- Leverage up to 1:500.

- Over three hundred distinct markets.

- Professional education support and center.

- Rapid execution and high liquidity.

- Spreads start from 0.0 pips.

Testing the Admiral Markets UK Trading Platform

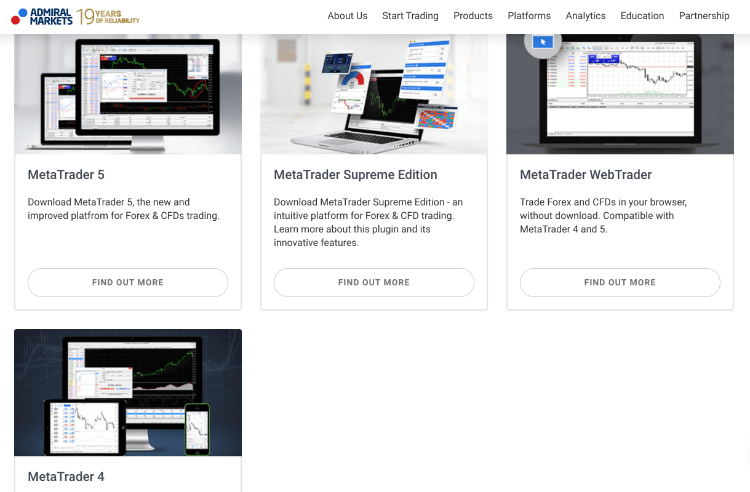

For professional trading, it is significant to have dependable and functional trading platforms. Most traders use some analysis to determine which tools or indicators are necessary. The upcoming section will introduce you to the distinct platforms accessible with Admiral Markets UK.

Given below are the platforms offered by Admiral Markets:

- MetaTrader 4

- MetaTrader 5

- WebTrader

- Mobile applications

MetaTrader 5 – It is the most popular platform and number 1 multi-asset platform chosen by traders and investors from all over the globe in trading futures, CFDs, Forex, and exchange-traded tools.

It contains thousands of convenient markets, trading bots, high-quality charting, VPS Support, education market, and free-market news and data. It offers advanced charting and trading widgets as well as automated trading options.

MetaTrader 4 is a user-friendly, responsive, safe, and flexible platform. MT4 is used for trading CFDs as well as Forex. Financial markets are analyzed and provide access to trading functions in a safe, quick, and trusted atmosphere. Its client support is available in multiple languages and also offers automated trading. Its advanced charting abilities are a plus point. It is customizable.

MetaTrader Supreme Edition – This platform contains the latest widgets, will enhance your trading experience, and is free. It has robust Global Opinion tools for MetaTrader 4/ MetaTrader 5 that improve your trading performance.

It encourages quick order reversal and hedging with order templates for OCA and OCO orders—dependable and ready order opening with predefined stop-loss, take-profit, and trailing stop.

It has a smooth and advanced indicator that allows you to see various time frames and charts in one chart. The chart movement can easily be traced, and you can stay connected and handle your entire account and every order.

MetaTrader WebTrader – It is a convenient platform. You can trade through a browser anywhere, and each moment is secure. It does not require downloading, has no operating system preference, and is quick to start.

“Quick Facts” regarding Admiral Markets Platforms:

- Safe

- Quick

- User-friendly

- Reliable

- Latest tools

Advanced Charting and Analysis

Technical analysis is crucial, and charting is one of the most important things you should learn.

The primary purpose is to facilitate your understanding of the trends and volatility of the markets. MT4 and MT5 are the software most suggested by dealers, and they’re famous as non-rigid and dependable trading platforms.

Admiral Markets encourages traders to give the same concentration to fundamental analysis as to technical analysis. As far as trading is concerned, both of them have benefits as well as drawbacks.

It’s significant to know these analyses since fundamental analysis facilitates you in comprehending market fluctuations. Combined technical analysis can lead you towards longer-term trends suitable for novice and experienced traders.

There are some types of Forex charts. The most common and popular one that traders use is Candlestick Charting since it is convenient, helpful, comfortable to work with, and not complicated for regular use.

Types of charts:

- Line Chart

- Candlestick

- Tick Chart

- Bar Chart

Admiral Markets UK Mobile App and Trading Platform

Mt4 and MT5 mobile applications are the best software that Admiral Markets for traders develop. This lets users access mobile trading via iOS and Android-powered mobile communication gadgets. It allows the users to place orders via mobile and perform technical analysis on fully functional charts.

Characteristics of MT4/5 Application:

- Change time frames

- Display Charts

- View real-time FX Quotes

- Receive messages from your dealer

- Add indicators

- Customize the platform

- It enables you to utilize every type of order

- Read Market News

- Access Trading History

- Access to every mobile and user-friendly feature for trading online.

You don’t have to google the present rate for your open position since the MT4/5 application also previews the current market situation. The application possesses one of the strongest chartings for Forex trading mobile apps.

These apps are readily available. Select a platform, authorize it with your trading account, and access the Forex trading advantages anywhere.

We recommend that beginners know about the platform’s features using a demo account to avoid accidental trade executions.

Trading Tutorial: How to Trade?

You have to opt for a market you want to trade on.

You should know about the market fluctuations going upwards or downwards. Make your decision on either “buy” or “sell.” If you think the market value will decline, press “sell,” if you believe the price value will grow, push “buy.”

It’s necessary to add stop-loss since it’s an order that protects your position from a specific process if it goes very far against you.

After placing the trade, the market prices can be traced, and live profits and losses can be monitored.

Step-by-Step Tutorial:

- Select an asset to be analyzed.

- Analyze the asset and predict price fluctuation.

- Open the order mask and change your position.

- Select the order volume.

- Restrict your profit and loss with the take-profit and stop-loss.

- Sell or buy the asset you desire.

Since Admiral Markets UK enables you to trade CFDs and Forex, you should know the difference between them. Forex is generally restricted to currency markets, while CFDs cover several markets. For instance, CFDs can be indices, commodities, or stocks. Through Admiral Markets, you can trade valuable metals or crude oil CFDs.

Trading Forex is more direct than CFDs. The trader trades a currency pair, which implies buying one currency pair and selling the other. Trading CFDs is more on contract details.

How do you open a Trading account?

A demo account can be opened using Admiral Markets’ three account types, i.e., “Admiral. Markets,” “Admiral. Prime”, and “Admiral.MT5”. It’s convenient and fast. What you have to do is to provide your full name and email.

Free Admiral Markets Demo Account

Anybody who wants to assess the platform before making any deposit can employ a free demo trading account. This account contains 10,000 US Dollars of virtual money, available for 30 days.

An advantage of using Admiral Markets’ demo account is that it offers essential tools that are accessible and used in a live trading account. It also provides a quick-start guide, which is beneficial for beginners. We highly suggest you get a demo account to test the platform before making any investments or deposits.

Types of FX Trading Accounts

Admiral Markets offers three account types.

“Admiral.Markets”

For this account, a minimum deposit of 200 US Dollars is required, and it is the most famous account of the organization. It’s a micro account offering leverage up to 1:500 and spreads starting from 0.5 pips.

Traders can choose between fifty-nine currencies and Precious Metals, Stocks, Energies/Crude Oil, Indices, and Bonds. It also provides access to the whole list of financial tools or instruments for trading.

This account is considered an outstanding account for trading online on a high margin because of the greater leverage and lower spreads that enable high-risk traders to benefit from the market’s movement or volatility.

Admiral. Prime – It’s the second account type in Admiral Markets. It requires an initial deposit of 200 US Dollars and a low leverage of 1:500. It starts from 0 spreads, and a commission of 3 dollars per lot is charged.

However, this account’s drawback is that it offers access to Precious Metal CFDs and Forex Pairs. It stops the traders from investing in other accessible assets in the market’s account.

Admiral.MT5 – It is a brand new trading account, and a minimum deposit of 200 US Dollars is required. It also has a minimum size of the order for every budget, i.e., 0.01 lots. It allows customers to open a MetaTrader 5 trading account, which has better trading requirements and guarantees quick market execution.

Admiral. Invest – This account is for trading over 4,350 Stocks and 200 ETFs. Only 1 USD would be enough to begin your investment. Admiral Invest provides access to distinct stock exchanges and a direct exchange execution with a 0.0 pip spread.

Deposit and Withdrawal Review

The deposit process in Admiral Markets is simple, and the most accessible payment options immediately process the transaction. Three days is the period for your fund processing.

Payment Methods That Can Be Used:

- Klarna (Sofort)

- Skrill

- Bank transfer/ Bank Wire

- Credit Cards (Visa, MasterCard)

- iBank&BankLink/ TrustPay

Admiral Markets uses reliable payment methods.

Cash deposits from banks are not an option for Admiral Markets (only bank wire is valid).

Controversy, the withdrawal course is the opposite. Skrill is the only payment method that processes your funds instantly, and the majority, via bank transfer, takes up to three days.

Trading Fees and Costs

With Admiral Markets UK, you can open a live or demo trading account free of cost. When using an online trading platform, you should know what fees you are paying or will be charged.

When using Admiral Markets, relevant information that you should know is given below:

- Trading fee: The minimum deposit required is 200 dollars

- Spread: The minimum variable is 0.0 pips.

- Swap fee: 0.10 dollars or equivalent in any other currency based on the asset.

- Inactivity fee: 10 EUR every month.

- Commissions: Admiral Markets might charge a commission on CFD shares.

Trader Support and Service in Multiple Languages

The best thing about the client support and service in Admiral Markets is its exceptional assistance. The organization’s support is accessible in 24 distinct languages, and customers can get help via phone, email, and chat.

Moreover, Admiral Markets UK has remote customer support, which is beneficial. The remote support quickly responds to customers’ questions or needs whenever the customer comes face-to-face with software-related or technical issues.

The support details of Admiral Markets UK can be found on their official site, admiralmarkets.com, and by placing your cursor on the “About Us” portion, you will obtain a drop-down menu in which you will find “Contact Us.”

Facts regarding Support:

-

- Phone Support

- Email Support

- Chat Support

- Supports a broad range of languages (24 distinct languages)

Admiral Markets UK also offers support by providing customers with educational and training programs. Such programs are accessible in online webinars and regular or free seminars.

These programs aim to educate the FX traders with essential skills in trading online, provide awareness regarding risks that may occur, and, of course, give customers a view of how the operation of the Forex market takes place.

Due to this, we can say that the organization provides excellent and remarkable support and service.

Approved and Restricted Countries of Admiral Markets UK

The countries that Admiral Markets UK accepts are given below:

Argentina, Australia, Austria, Slovenia, South Africa, Spain, Bahrain, Belarus, Brazil, Bulgaria, China, Croatia, France, Finland, Germany, Greece, Kuwait, Malaysia, Malta, Mexico, Monaco, Netherlands, Norway, Latvia, Liechtenstein, Cyprus, Czech Republic, Denmark, Estonia, Lithuania, Luxembourg, Hungary, India, Ireland, Israel, Italy, Oman, Poland, Portugal, Russia, Saudi Arabia, Slovakia, Sweden, Switzerland, Thailand, United Arab Emirates, United Kingdom, Qatar.

Admiral Markets does not accept US customers.

To Trade or Not to Trade with Admiral Markets UK

Admiral Markets has proved its worth and loyalty for over 19 years and is one of the industry’s dominating dealers. The organization offers excellent support to its customers.

It also offers fully-functional software and aims to provide a clear and good trading experience. It also offers its customers educational and training programs to help them make well-informed trading decisions.

We suggest Admiral Markets UK since it is a legal, dependable, and secure CFD and Forex trading dealer. The dealer is reputable, verified, and regulated. Since it is one of the 1st CFDs and Forex dealers in the industry, it has the most advanced and efficient tools and easy-to-use platforms. It also offers mobile trading.

FAQ:

Is Admiral Markets a quality dealer?

Established in 2011, Admiral Markets is regulated in two tier-1 and two tier-2 jurisdictions, making it a secure CFDs and Forex trading dealer. For instance, clients can access Dow Jones News, Acuity Trading, and Trading Central with Premium Analytics.

Are Admiral Markets regulated?

Admiral Markets was established as a CFD, Forex, and Stock dealer in 2011. FCA, ASIC, CySEC, and EFSA regulate Admiral Markets. The organization is a member of the FSCS (Financial Services Compensation Scheme), providing negative balance security, separate accounts, and excellent safety and security levels.

Is Admiral Markets an ECN dealer?

Since Admiral Markets offers ECN and STP executions, you can anticipate very tight spreads with more clarity over the price you pay to implement your trades. As with most dealers, margin requirements differ depending upon the trader, instruments, and accounts. You can check the latest margin conditions on their official site.