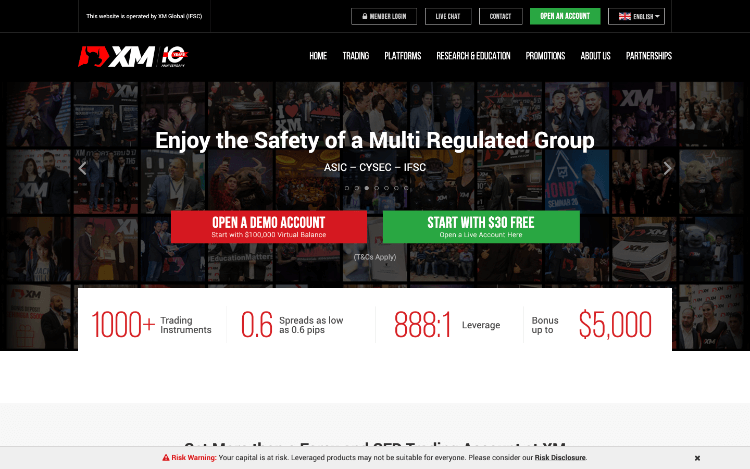

XM Forex Broker was founded in 2009 and has over 1,500,000 clients worldwide. Since then, the firm has grown to such an extent that it is considered the largest and most established investment firm globally.

The company aims to execute 99.35% of all its trades within a second without re-quotes and rejections. Moreover, the company provides access to clients from more than 190 countries in over 30 different languages.

XM Forex Broker – Background Information

So, the XM comprises a team of online regulated FX brokers. The “Trading Point of Financial Instruments Ltd” company was founded in Limassol, Cyprus, under the regulation of CySEC (120/10).

In Sydney, Trading Point of Financial Instruments Pty Ltd was established and regulated by ASIC (443670). Let us kindly mention some of the best features of this platform that are mandatory to consider while viewing XM as an online broker.

The XM delivers a wide range of services like equity indices, currency trading, CFDs, energies, precious metals, etc. The clients can also pay through more than twenty-five secure payment methods from sixteen complete feature trading platforms.

A team of online regulated brokers forms the XM Group. 2009 Trading Point of Financial Instruments Ltd was established in Limassol, Cyprus.

CySEC regulates the company with license number 120/10. Later, in 2017, XM Global Limited was established with headquarters in Belize. The firm’s regulation is by the International Financial Services Commission (IFSC/60/354/TS/19).

Pros and Cons

Advantages:

- Established in 2009

- More than 1,500,000 traders prefer it.

- FCA, IFSC, CySEC, and ASIC regulate it

- The minimum deposit is €5

Disadvantages:

- A fee is charged if inactive.

To open a live account, you must deposit €5, at least. Also, to understand the trading process, XM even facilitates the traders with a demo account. Using demo accounts, the clients familiarize themselves with the platform.

The XM is regulated by CySEC (Licence: 120/10) and ASIC (AFSL #443670). The firm ensures the clients’ safety by using segregated bank accounts in tier-1 banks to keep their funds. The XM has competed since its establishment in 2009, with the main office in AU.

Before discovering more details about XM, like its spreads, platforms, trading features, and spreads, you must open the XM Group website in a new tab. For that, click the button below to see the latest updates from the XM Group’s site.

Around 71.6% of retail investors lose money with this provider while spread betting and CFDs.

What are the Spreads and Fees of the XM Forex Platform?

The XM broker, like the majority of brokers, charges a fee on the spreads. The cost is the difference between the instrument’s purchase and sales price.

A few commissions and spreads are given below based on the minimum spreads mentioned on XM’s website. Different color bars represent the competitive XM’s spreads compared to other brokers featured on BrokerNotes.

What does the XM charge to trade one lot of EUR/USD?

So, if someone buys a standard lot of EUR/USD (100k units) from the XM with the exchange rate of 1.1719 and sells it at the same price the other day, they will have to pay $9.85. Below is how the fees are calculated, along with a comparison with XTB and AvaTrade.

What is the experience with XM?

Platforms and Applications – One of XM’s unique features is that it delivers both MetaTrader trading platforms. Only a few brokers offer MT4 and MT5 together. If you want to compare both platforms, read the comparison of MT4 vs. MT5 here.

The firm offers easily accessible platforms on Mac and Windows, and all traders can download the platforms and trade from any device. In addition, XM broker allows trading on the move via mobile apps on Android and iOS.

Execution of Trades – With the XM, traders can execute a minimum trade of 0.01 Lot and a maximum trade of 100 Lot. However, the values depend upon the choice of your account.

XM has low entry requirements in comparison to ECN brokers. Such firms ask for more capital and minimum trade requirements and offer high trade volumes. Market makers like the XM ask for a lower minimum deposit, have low minimum trade requirements, and take no commission on trades.

As an exciting bonus, unlike most brokers, the XM Forex traders do not have to worry about slippage (the trades being ordered at a different price than what one executed them). The reason is that the firm claims to have no re-quotes.

Most brokers’ margin requirements change depending on the traders, accounts, and instruments. To see the new margin requirements, visit their website.

Additionally, the XM Group brings diverse risk management features for safe trading, like stop losses, limit orders, negative balance protection price alerts, etc.

XM’s Trading Features:

- Enables scalping

- Offers to hedge

- Less minimum deposit

- Gives Negative Balance Protection

Account Options Offered:

- Islamic account

- Demo account

- Standard account

- Zero spread account

- Micro account

Payment Methods:

- Bank Transfer

- Credit cards

- Skrill

- Neteller

- Payoneer

Customer Support

Well, the client support of the XM is excellent. The firm offers customer services in multiple languages like Chinese, English, Italian, Malay, Polish, Arabic, German, Hungarian, Japanese, Portuguese, Russian, Spanish, Thai, Swedish, Korean, Indonesian, French, Greek, Hindi, and Turkish.

Surprisingly, the XM Group has a double AA support rating in “BrokerNotes” as it offers more than three languages.

What are the Requirements to Open an FX Trading Account with XM?

So, the XM Group is regulated by IFSC, CySec, and ASIC, so all new users must undergo compliance checks to ensure that they know the risks of trading and are eligible to trade. While opening the account, you will be asked a few questions, so it’s good to know them beforehand to avoid delays:

- One scanned color copy of a passport, driving license, or national identity card.

- Original utility bill or bank statement from the previous three months with a visible address on it

Other than these necessities, to confirm your trading experience, you will have to answer some basic compliance questions. Therefore, completing the account opening process takes a minimum of ten minutes.

Although you will discover the XM Group’s platform immediately, remember that you won’t be able to trade unless you pass the compliance test. Also, note that this process might take several days, depending on your situation.

XM Forex Trading Platforms

XM offers numerous trading platforms, like Web Trader, MT4, and MT5.

In this, Web Trader allows traders to access real-time market information directly. The clients on this platform do not have to install any software to track trading. Hence, it is considered an excellent platform for all clients with limited hard disk space and those who want to reach through a smartphone.

The MetaTrader 4, or MT4, is one of the most famous trading systems. The platform offers exceptional features like precise movements, a user-friendly nature, and transparent prices. Also, the MetaTrader 4 platform gives both manual and automatic trading options.

Types of Trading Accounts

The first type of trading account is a Micro trading account that the clients can open with $5. Micro accounts are for those who aim to learn the forex markets and make trades in small/ micro-lots.

Next is XM’s Standard trading account. The name says it all! It is for seasoned traders mainly. These traders wish to expose themselves to moderate risk using standard lots, and these types of accounts have contracts of larger sizes.

The Zero Accounts of the XM require a minimum deposit of $100 and deliver very low spreads like zero pips with XM’s no re-quotes. Moreover, remember that the firm charges a $7 commission on every $100,000 trade from their Zero Account.

There are Demo accounts available with XM. Such accounts are for clients who want to check the platform before deciding. Surprisingly, more than $100,000 are given as virtual funds for virtual trading.

Other than that, XM offers Islamic accounts. These are for clients who wish to trade while following the guidelines of Sharia law.

XM Commissions and Spreads

Like most online Forex brokers, XM spreads depend on the trading systems and account type. The tight spreads can even be as low as zero pips (for zero-spread accounts).

Another benefit in terms of pips is the fractional pricing on XM. The firm provides five digits instead of what other sites offer, which is standard four digits. The trader has the choice to pick from fixed and variable spreads.

Also, XM charges no commissions. Instead of this, the site gets profit by trading spreads themselves. Hence, the site has no hidden charges, and traders’ gains and losses are accurate.

Underlying Assets

There are many different instruments that you can trade on XM. Some of the most popular assets include:

- Forex

- Equity Indices CFDs

- Commodities CFDs

- Energies CFDs

- Stocks CFDs

- Precious metals CFDs

The platform does not support any EFT trading.

Accuracy and Efficiency

Many people consider XM.com a reliable platform for those who aim to execute real-time trades (Almost 100% are completed within one second). All the figures are transparent as they are on the execution of a position without re-quotes.

There is a broadcasting delay between the observed prices and actual market rates because of the trading platforms mentioned above. Though, this somehow depends on the processing power and connection speed of one’s computer.

Payments and Withdrawals

The XM’s site allows payments in almost all Local Payment Methods like Neteller, Bank Wire Transfer, Credit/Debit Card, Skrill, etc.

Also, remember that the platform does not currently support the deposit or withdrawal of funds through PayPal.

Trader Support

The level of customer engagement and support the XM.com platform provides is outstanding. They allow customer services in the form of a Live Chat widget, email, and telephone number to clients of all the accounts. The best thing about XM is that it provides customer service in over twenty languages.

Furthermore, facsimiles can be sent to four numbers depending on the trader’s location. Note that these clients’ support services can only be accessed from Monday to Friday. The queries on the weekends will be addressed on the next working day.

To Trade or Not to Trade with XM

The XM Group is a popular broker site for all traders. The features that make XM unique include high reliability on trade, easily manageable and accessible platforms, and no rejection of orders.

With all the pros mentioned, there are some cons, too. For example, XM does not support PayPal for payments right now. The three account types (other than the risk and trading volume) have some differences.

Lastly, the lack of customer support on all days is a drawback of the XM because some may want to execute positions during the weekend.

To sum up, the XM group is one of the most potent Forex brokers available online, and one must not miss it.

FAQ:

Is XM a good broker?

The XM Group was established in 2009 and is regulated in two tier-1 jurisdictions, and one tier-2 authority makes it a safe broker. Also, XM is a vanilla MetaTrader broker that brings a complete MetaTrader suite but shows no notable upgrades to better the experience.

How much time does it take to withdraw from the XM broker?

On XM, their back office processes the traders’ withdrawal requests within a day. You will get the amount on the same day if payments are from e-wallets. However, payments by bank wire or credit/debit card take 2 – 5 working days.

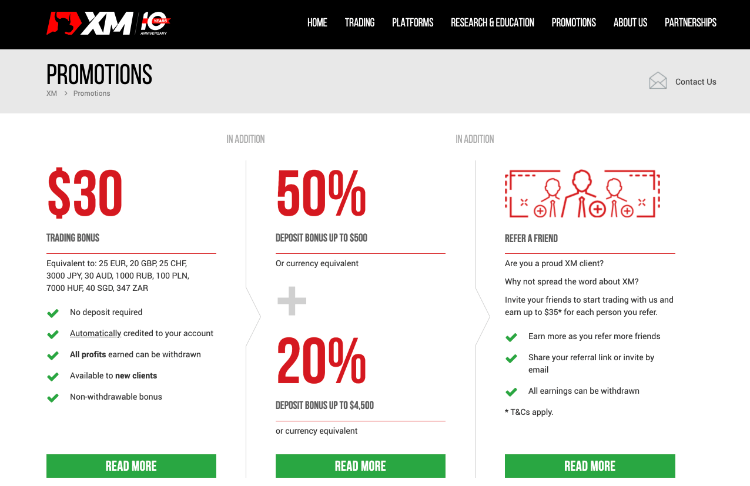

Can we withdraw the XM bonus?

The XM gets access to the No Deposit Trading Bonus Scheme for all the clients who open a real account. However, the clients have to abide by the scheme’s rules and then are given trading bonuses that they may use for trading purposes only. You cannot withdraw these bonuses on the XM broker’s site.