Saxo Bank is one of the leading, most trusted, and reliable banks out there in the brokerage industry is Saxo bank. It is a European bank, fully licensed, and is quite famous globally.

It serves its purpose by catering to all kinds of people, whether professionals or beginner traders, hedge funds, and other relevant institutions. Clients can trade over a variety of 35,000 assets, divided into eight broad categories at Saxo bank.

Saxo Bank – Background Information

Founded in 1992, the fintech investment bank was named Midas Fondsmæglerselskab by Lars Seier Christensen, Kim Fournais, and Marc Hauschildt and was based out of Copenhagen, Denmark.

The name Saxo Bank was acquired in 2001 when the bank received its official banking license. It was approved on May 2nd, 1996, under the European Investment Direction to be the first Danish broker.

Saxo bank aims to provide brokerage services and white-label partnerships, but it does not offer traditional banking activities even though it does possess a full banking license.

The bank is associated with over a hundred financial White Label Partnership institutions. Other banks like Old Mutual Wealth, Standard Bank, Banco Best, and Banco Carregosa are also in a mutual partnership with Saxo Bank.

With time, Saxo Bank has expanded globally and serves clients in more than 180 countries. The bank has reached a global platform and opened multiple offices worldwide in cities such as Zurich, Dubai, Paris, India, Tokyo, London, and Singapore. As a leading brokerage industry, Saxo bank also has around fifteen financial regulatory centers.

Saxo Bank’s ownership is privately divided at 50% by Geely Financials Denmark A/S (a branch of Zhejiang Geely Holding Group Co. Ltd.), followed by a request of 25.71% by the co-founder and CEO, Kim Fournais. The final 19.90% of ownership is by the Nordic financial services group Sampo Pic and by recent and past employees of the bank.

Minimum Deposit to Open a Trade Account with Saxo Bank

The minimum deposit fee for professional traders is €/$50,000, as the bank aims to attract expert players a lot. However, the Classic account is explicitly designed for beginners and requires only €/$500 as the minimum deposit limit.

Regulation and Security

As highlighted above, there are around fifteen global regulatory financial centers that are responsible for the effective and transparent functioning of Saxo Bank. The license number of Saxo Bank A/S is 1149, the registration number is 15731249, and its headquarters are in Denmark.

The other subsidiaries responsible for regulating Saxo Bank include Saxo Bank A/S Czech Republic, Saxo Bank A/S Netherlands, Saxo Bank A/S Cyprus, and Saxo Bank A/S Italy, all of which are supervised by the Danish Financial Supervisory Authority (FSA.)

The Danish law constitutes the EU Banking, and Investment Directives followed and implemented by Saxo Bank as part of the European Union.

Since 2006, Saxo bank has expanded to the UK as an active and functional brokerage under Saxo Capital Markets UK Limited. Authorized and regulated by the FCA (Financial Conduct Authority), its firm reference number is 551422.

To maintain as much transparency as possible, Saxo bank’s website has published all its legal licenses and documents along with relevant information. This way, traders are ensured of the bank as a reliable and safe global financial system.

Before fully committing and investing in Saxo Bank, it is essential to read the Key Information Document (KID), which comprehensively mentions all the trading asset classes to ease the retail traders. Even though the bank works on a massive international scale, the main regulating and authoritative body is the Danish law-regulated Saxo Bank A/S.

Saxo Bank has always prioritized its clients and adheres to all laws and regulations. All clients have segregated accounts with complete security and safety. As a Danish bank, the Guarantee Fund for retail clients thoroughly guarantees the deposits made by these clients, and it does not cover institutional clients.

Also, the regulators of Saxo bank strictly play their part in fighting against money laundering. All clients, beginners, and professionals alike can completely trust and rely on Saxo Bank as it is a highly trustworthy, secure, and safe leading brokerage bank that offers a wide range of assets.

Trading Fees

The differences between ask prices and the bid prices in trades are the spreads through which Saxo Bank earns its income. Along with the margin positions with overnight financing and commission trades are the ways through which Saxo bank acquires its trading fees.

It merely depends on the class of assets for commissions, which could be as little as $1.25 per lot, while spreads have been known to be as low as 0.4 pips. To prevent high-volume traders from coming in, Saxo Bank offers better trading conditions and the application of swap rates.

As there is a diverse range of assets offered by Saxo bank, the type of asset being traded determines the level of financing. For the ease of the clients, the bank has given complete access to clients of the pricing online ranges for all respective assets. Their website offers a built-in navigation tool that redirects to the pricing models for each asset.

To get information and access to the costs of trading, there are dedicated sections on the Saxo Bank website and platforms that can better guide clients. To find out the rates, click on ‘Account’ >> ‘Trading Conditions’ >> ‘CFD Stock/Index Instrument’ >> ‘Borrowing Rate.’

Saxo bank also has some other charges, which are mentioned below:

- If the trader account has not been active for one quarter and contains cash only, an inactivity fee of €/£25 will be charged.

- If applicable, interest rate credit charges will be taken on the accounts with more than €/£15,000.

- A minimum monthly fee of €/£10 and a 0.12% annualized Bond, ETF/ETC, and Stock positions will be charged.

- Orders placed on the phone will be charged a standard fee of €/£50.

- The fee for transferring exit positions to other brokers is known as Transfer Out Fee, and the charges per ISIN are €/£50 (maximum of €/£160).

- At the mid-FX Spot rate, a currency conversion fee is applicable, which could amount to +/- 1%.

- At marginal requirement, the carrying cost multiplied with the number of holding days multiplied by the sum of relevant interbank rate and markup, all divided by 365 or 360 days, will also be charged.

- A holding fee applies too, which will be at a nominal value/1,000,000 multiplied by the cost of the underlying category.

- If clients request that their online reports be delivered through email or mail, a reporting fee of €/£50 applies.

- For all positions less than 50,000, a minimum of €/£10 FX Options Ticket Fee applies.

Naturally, as many tradable assets are available at Saxo bank, it makes sense to have a complex and detailed fee structure. All the costs, including their examples, are comprehensively mentioned under ‘Commissions, Charges and Margin Schedule’ for the clients.

Beginner traders may feel confused and retail traders may feel overwhelmed. However, if they read through the guide, all information will become apparent and straightforward for them to understand and process.

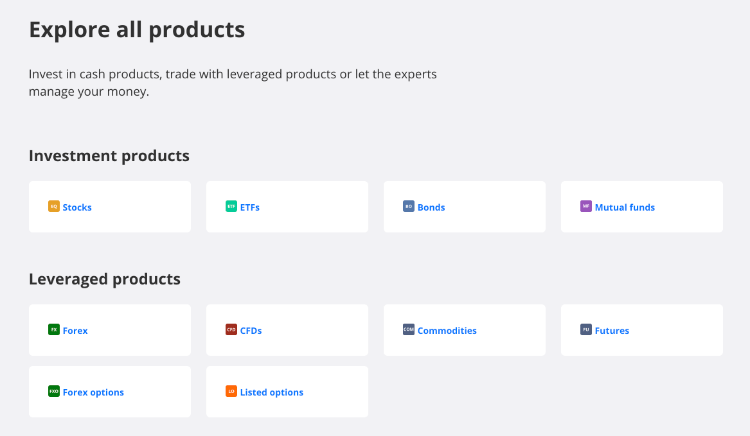

Which Assets Can I Trade at Saxo?

As mentioned in the beginning, there are around eight total broad categories that feature a sum of 35,000 various assets for trading. Saxo bank is a leading brokerage, famous worldwide for its remarkable portfolio.

With so many assets to choose from, it might become overwhelming for beginner traders. However, depending on the field of expertise of the trader, choosing the right trading assets might not be that difficult. As a multi-asset brokerage, Saxo bank appeals significantly to those traders who run many multi-asset trades.

With the impeccable collection of available assets, the transparency, the cost-effective pricing, and the presentation, Saxo Bank has outdone itself. Online tools are also available, which can help traders navigate through all the information on all assets and their pricing, etc.

Saxo Bank Account Types

For all the retail traders, there are around three different types of accounts that can be opened up at Saxo Bank. With professional accounts, an option to create a joint account is also available.

Each account type has pricing models, additional features, offered services, minimum deposit limits, and other perks. Based on the trading volume and frequency, traders can upgrade as well. Clients also have the option for trust fund accounts and corporate accounts if they possess the two particular UK account types.

Classic and Platinum Accounts

The Saxo Classic and Platinum accounts are the main two options available, especially for all the retail clientele. The standard account for traders at Saxo Bank is the most approachable and comfortable account type, which comes with a minimum deposit limit of €/£500.

In contrast, the minimum deposit limit for Platinum accounts amounts to €/£50,000. However, with platinum accounts, there is a 30% decrease in the spreads, which dramatically helps expand the portfolios. All clients who deposit more than €/£1,000,000 can open a VIP account.

Clients are allotted tiers as soon as they open their accounts at Saxo Bank. Movement along the lines depends on the frequency and volume of deposits made and the account holder’s activity.

There is a review of these factors conducted every three months, after which, without any extra fee, the tiers of active clients are raised. With higher tier levels, there are more benefits with much more favorable trading conditions, especially for those business traders who started small but are making profitable trades on the platform.

The three account types can be converted into joint accounts at Saxo Bank for first-line family members.

Professional Account – The minimum portfolio amount for professional accounts is $/£500,000, and features like less protection and more leverage are offered to the clients. Due to some trading instruments, retail traders find themselves at a bit of a disadvantage due to the level of protection provided.

An experienced finance experience of one year is mandatory for a professional account, along with a minimum of ten vital trades conducted in the past year. For margin trading, collateral may be in the form of securities used.

ISA Account – Only offered to residents of the UK; this is a tax-free allowance account. In 2020, the ISA allowance was capped at £20,000. This account will not have any income tax or capital gain charges. Also, leftover funds are not allowed to roll over into the following year. This account offers around 11,000 asset types to traders.

Trust Account – This account type is ideal for all those trust fund managers who want complete access to the markets available globally. Via the trading platforms Saxo offers and its regulatory environment, global market access is given to the managers.

Saxo VIP Account – With a minimum deposit limit of €/£/$1,000,000 along with marvelous special features, the Saxo VIP account is available for corporate clients and even other individual traders.

Trading Platforms

Saxo Bank has two main versions, the SaxoTraderPRO and the SaxoTraderGO, developed by their teams. Not only is there a highly functional desktop version, but they also have a mobile version and a web-based platform.

All the White Label Solution partners are also being provided a top-tier trading platform by Saxo Bank. However, those traders who have used and are addicted to the MT4 and MT5 forex trading platforms will not be satisfied with Saxo Bank as the platforms at Saxo bank are pretty different.

The trading platforms offered at Saxo bank are much more enhanced and better than the MT4 and MT5 ones, providing a higher quality experience compared to cTrader.

Third parties can also connect with SaxoTraderGO and SaxoTraderPRO through the APIs Saxo Bank offers. Due to this, full access to the market portfolio of Saxo Bank is available through the development of superior trading applications.

Unique Features

Along with the proprietary platform for trading, factors such as the vast asset collection, remarkable services, and complete transparency make Saxo Bank stand out amongst all its competitors. Third-party platforms are also well-supported by the API known as Saxo Advanced Solutions.

Not only that, but more than 100 financial institutions have partnered up with Saxo Bank, and they provide top-notch technology and related services. Saxo Bank is considered a high-end and exceptional finance trading market with massive leaps of success.

Research and Education

Saxo Bank has always placed a great deal of importance on providing educational and research services to clients all over the world. Their market research teams are spectacular, along with the highly informative webinars, events, and video courses the bank offers.

There are a total of eight highly skilled individuals who are strategists and analysts for the bank and are known as the SaxoStrats Experts. They are responsible for managing, arranging, covering, and offering clients classes on the full spectrum of assets.

For beginners, these courses are splendid as they cover everything thoroughly. New traders learn and get acquainted with the basics and asset types and details through the videos and webinars, which gives the traders a certain level of comfort and confidence. Saxo Bank experts run the events and webinars and ensure to provide individual sessions.

The brokerage is known to maintain excellent professionalism and is exceptionally well-organized overall. To improve trading methods and strategies and help the clients, Saxo bank tries its best to put out fresh and innovative ideas along with commendable market research regularly.

Research – The idea is to make it simple for traders to navigate through and avoid wasting time by quickly finding their areas of expertise and interest. It is done by the research sector, which offers various categories of researched material for the clients.

These categories include market analysis, outrageous predictions, equities, thought starters, forex, quarterly outlook, recession watch, macro, and IPOs.

Education – The educational sector comprises a few vital categories, such as events, courses, webinars, etc. The video courses are the most popular due to their impeccable quality and content, followed by the webinars and the events hosted by Saxo Bank experts.

Trader Support

Saxo Bank has always aimed to deliver premium quality services in a friendly, interactive trading environment such that the need for customer support may not have to arise. However, they have a highly detailed online database, including information about the most popular questions and topics.

The bank also offers an online chatbot along with worldwide telephone support. From inside the trading platforms, a support ticket can be requested too. Regardless of the kind of issues customers may face, Saxo bank has always stood firm and helped clear out all problems by expertly guiding their clients and customers.

Bonuses and Promotions

There are numerous incentives available for clients who perform regular, high-volume trading, along with the availability of a diverse collection of assets. Other than that, Saxo bank does not offer particular promotions or bonuses for their customers.

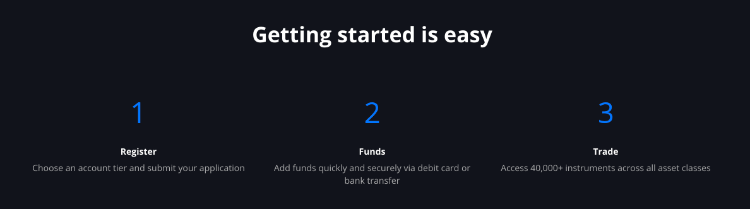

Opening an account with Saxo

A 5-minute online form is all that is necessary to open an account at Saxo bank. This form includes the details of crucial verification documents that are needed by the regulations of KYC and AML. Overall, opening an account is straightforward and smooth, leading to the clients getting full account access in only a couple of quick minutes.

Deposits and Withdrawals

Wire transfers, debit cards, credit cards, etc., are all the banking methods available for making withdrawals and deposits at Saxo bank. The trading platform manages the entire process efficiently.

Usually, there is no fee for making deposits at Saxo bank. There are no charges if the Online Cash Withdrawal Module is used to make withdrawals. However, if the form is submitted for mutual funds withdrawal, a $40 fee is applicable here.

It is one of Saxo bank’s banking features because its banking methods are still old school even though it is a fintech company. We do hope to see some positive advancements in the future in this area of asset transfers as they are one of the top-tier trading banks in the world so far.

To Trade or Not to Trade with Saxo Bank

As a brokerage, Saxo bank has been doing an excellent job. It is a fintech company with a proprietary trading platform that is above all other trading platforms like MT4 and MT5.

The investment bank is managed and regulated quite efficiently and offers a massive multi-asset variety of more than 35,000 assets, divided into eight main categories. The bank caters to professionals and experts, retail traders, and even beginners.

As the most straightforward account requires only a €/£500 minimum deposit amount, Saxo bank is preferred over others. The bank also attracts high-volume traders due to its remarkable asset collection.

They also offer educational courses, videos, and webinars and host informative events to help the traders immensely. With proper capitalization, there is also an outstanding research team of Saxo experts who aim to work tirelessly and make the trading experience excellent at Saxo bank.

More than 80,000 clients are already hooked onto Saxo bank, and more and more keep opening their accounts here as the process is relatively straightforward.

The professionalism, transparency, security, incentives, and other services offered at Saxo bank make it a fierce competitor to beat. The diversified portfolio, along with global expansion, has helped Saxo bank make quite an outstanding trading reputation for itself.

FAQ:

Is Saxo Bank a good broker?

The trading platform is one of a kind, with low deposit limits, a considerable asset variety, and unparalleled services. Compared to its competitors, the bank charges lesser commissions as well, and as a fintech company, they use a highly advanced and intuitive interface.

How do you use the Saxo market?

The most famous market at Saxo Bank is the SaxoTraderGO, which has its online website and is relatively straightforward. Registering a trading account with Saxo bank will take a few minutes, and it is effortless to make the minimum deposit using your credit card or bank transfer (FAST or PayNow). Once done, you can merrily begin your trading journey.

What is the maximum time needed to open a Saxo account?

Specific verification documents are necessary to open an account that will be vetted in detail, and the maximum time taken by the process of opening a private account is approximately two working days.