City Index is one of the premium FX trading broker companies in the United Kingdom. The company began operating in 1983.

City Index started offering contracts to global customers in 2001. In 2005, the organization acquired its spread betting competitor, Finspreads, active since the year 1999.

We have uncovered everything about this broker. So, please kindly keep reading our in-depth City Index review before you trade with your real money.

City Index – Regulation and Licensing

From a regulatory point of view, the head office of City Index is in London, England, and the UK’s FCA regulates it under license number 113942.

Moreover, the company’s parent GAIN Capital is under the regulation of CFTC and NFA in the USA, FSA in Japan, IIRO in Canada, FCA in the United Kingdom, SFC in Hong Kong, and MAS in Singapore, CIMA in the Cayman Islands, and ASIC in Australia.

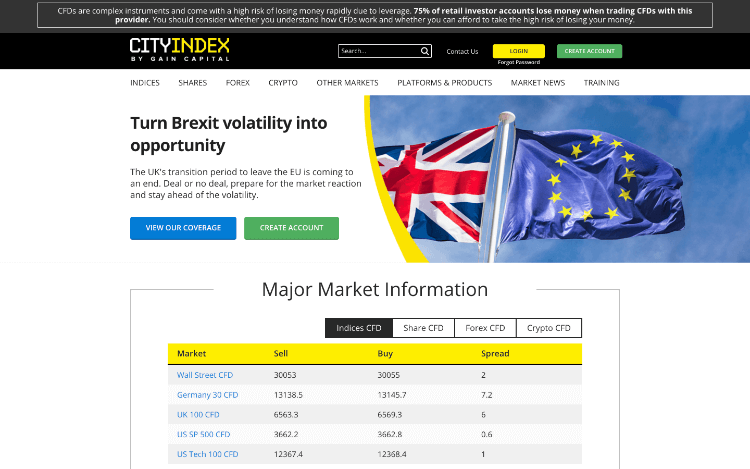

City Index firm has been under the ownership of Bedminster, New Jersey-based GAIN Capital since 2014. It also owns an online Forex broker Forex.com and forex ECN GTX. The official website of the City Index is www.cityindex.co.uk. Also, you can see the screenshot of the homepage of City Index’s official site below.

Markets and Background Information

City Index offers its clients the chance to trade in more than 12,000 markets. These markets have several commodities, forex currency pairs, individual stocks, and indexes.

From a size perspective, businesses related to GAIN Capital’s trading, including City Index, have an average of 501.2 billion monthly trading volume. The firm has over 140,000 retail clients from 180 different countries. Also, City Index has approximately 800 employees from four continents.

City Index Deposits and Withdrawals

For signing up for an account on City Index, you will need enough initial deposit to meet the trade margin requirement of your first trade or at least a £100 initial deposit. To deposit funds into City Index’s trading account, you can use bank wire transfers, Maestro, MasterCard, Electron debit cards, Visa credit cards, etc.

You can withdraw funds by withdrawing a minimum of £50 from your account. Draw the entire account balance if your account balance is less than £50.

The clients can withdraw a maximum of £20,000 per day. People who use credit cards for withdrawing funds get an additional limit of £20,000. Generally, no fee is charged to withdraw funds. However, withdrawals from CHAPS payments cost you £25 on payments less than £5,000.

Withdrawing funds from City Index can take three to five working days usually. Although the bank wire transfers take less time, that is, one to two working days. Also, banks with partnerships with faster payment services allow withdrawals within a single working day.

Trading Platforms and Tools of City Index

City Index supports three primary trading platforms that are given below:

- Advantage Web – The platform received a “Best Spread Betting platform” award from ADVFN in 2017. It is a fully customizable and straightforward web trading platform. Advantage web offers twelve interactive types of charts along with eighty technical indicators. Moreover, the site delivers a research portal and Reuters news feed that give the traders ideas with fundamental and technical analysis.

- AT Pro – The main aim is to provide experienced traders with pro functions and a customizable interface. The clients on this platform get to choose from numerous existing templates. Furthermore, AT Pro users can also create their choice templates using .NET, C#, and Visual Basic programming languages. The trading platform offers different charts with more than a hundred indicators. Besides, AT Pro also enables the clients to track their trading plan using historical data through back-testing tools that excel. Not just this, you will find various beneficial strategies on the site like a MACD line crossover system, a moving average crossover system, and the Heikin-Ashi reversal system that uses candlesticks.

- MT4 Trading Platform – The most popular platform supported by City Index is MT4. The platform is a combination of the best trading tools along with competitive variable spreads for dealing. The primary MT4 platform has advanced charting elements, changeable indicators, and expert advisor capability. With the Expert Advisor tools, the traders can build unique trading strategies, trade using trading robot packages, or utilize the off-shelf trading signals.

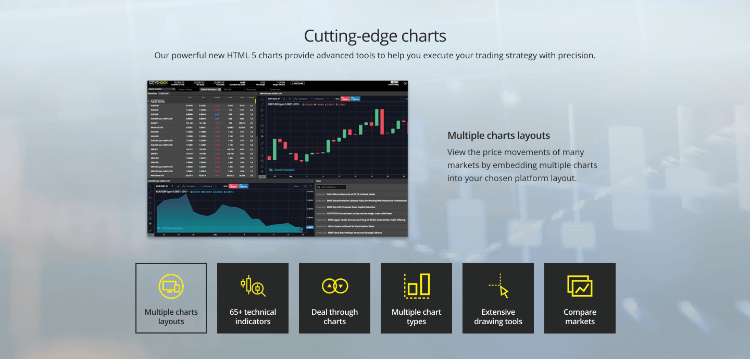

The screenshot attached below shows the working of the proprietary Advantage Web platform of City Index. It will help you check your account, monitor it, and provide technical and fundamental analysis support.

Advantage Web and AT Pro users get a precious Reuters news feed that helps them stay updated on financial news, quick economic data release announcements, etc.

Additionally, you can trade on the move with City Index. They offer mobile trading platforms with compatible applications for Android and iOS mobiles, tablets, etc.

Along with the platforms mentioned above, they also provide a Trading Signal service and an Economic Calendar. Using this service, users get free notifications through SMS.

For availing of the SMS alert service, subscribe to the service manually. All the account types on the broker give you access to Trading Central.

Asset Categories of City Index

The City Index has a secure financial backup from the well-known GAIN Capital. For this reason, the broker offers competent prices and competitive trade execution services with its numerous trading instruments and award-winning trading platforms like MetaTrader 4.

Currently, traders are allowed to trade:

21 Indices – Indices with names like Wall Street, Australia 200, UK 100, Germany 30, etc., with options and futures on the given indexes.

4,500 Global Stocks – Major companies’ shares like Apple, Deutsche Bank, Rio Tinto, Amazon, and Barclays.

84 Forex Pairs – The forex pairs that City Index Clients can trade include all currency pairs and some exotic pairs.

More than 25 Key Commodities – The traders can place future contracts on hard commodities like energy, cocoa, grains, cattle, cotton, etc., and other soft commodities.

Other Financial Markets – Precious metals including platinum, gold, silver, copper, palladium, etc.; Bonds of US, UK, and Eurozone; Interest rates including Euribor, LIBOR, and Short Sterling along with many other options of financial asset contracts.

5 Cryptocurrencies – City Index allows trading of virtual currencies that include Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple’s XRP token. Although the broker claims to offer Ripple for trading, it is the company behind the XRP digital asset and others that are hard to trade as cryptocurrency.

Contracts for Differences (CFDs) – They are financial derivatives that allow the trading of cryptocurrencies. So the traders can bet on the BTC/USD pair’s price movements. For this, they will not need to own digital assets from the broker. Along with CFD-based trading, City Index clients are allowed to spread bets on Bitcoin from just 10p.

Furthermore, the City Index’s clients get spread betting CFDs trading accounts facility and particular forex trading account for those willing to use MT4. To test the firm’s services, they enable you to open a demo account and have a quick tour of the broker’s trading services.

City Index Trade Commissions and Fees

City Index supports three real money account types other than the risk-free demo account. The three accounts it offers are Trader, Premium Trader, and Professional Trader.

The firm earns money from the specified and varied spreads that it takes on traders. The traders are informed about the exact spread size the firm will charge before they begin trading.

However, the broker charges no other commissions on its CFD or spread betting services, whether FX-based or based on other markets. Yet, some commission is charged on CFD equities.

The minimum amounts of the commission charged are USD10, GBP10, or EUR10. Note that the commissions depend upon the markets, like the broker charges 0.08% of the consideration on UK/EU equities, whereas Asian equities incur a heftier commission of 0.2%. Similarly, a commission of 1.8CPS is charged on US equities.

Along with the rates given above, some additional expenses will be charged on overnight financing.

Usually, the financing rates for long positions are LIBOR+2.5%, and for short positions is LIBOR-2.5%. However, no or low liquidity may lead to additional costs under special borrowing charges.

Education and Research

The broker comprises a training center and the site’s education section. The training center includes a variety of specialized training courses for new and experienced traders. The offered courses also discuss the trading platforms’ entry and exit price levels.

There is a strategy section specifically for the traders who wish to advance their technical and fundamental analysis skills. The brokers have mentioned specific ways to exit and optimize trades.

City Index offers a step-by-step guide on how to trade and ends with how to prevent one from trading risks.

The webinar section is of utmost importance as it discusses the trade themes and market outlooks. You can get briefing videos daily in this section.

Considering the education and analysis, the tools on offer are outstanding.

Trader Support

There is excellent client support offered 24/5 by City Index. The broker’s clients can contact the support agents via email, phone, live online chat, etc. The clients are also not bound to one language as the firm brings customer support in multiple languages.

Moreover, there is a wide range of educational tools for traders. So, whether new or old to the forex market, you must visit the firm’s Trading Academy. There are educational videos, webinars, support pages, tips, and techniques regarding trading.

City Index Mobile Trading App

You can download City Index’s free Android trading app from the GooglePlay platform in seconds. The mobile platform gives an appealing user interface along with living synching and live-chatting features.

Additionally, it gives the traders an Economic Calendar and supports various personalized watch lists.

You can even install the iOS app on your iPhone for free with all the abovementioned features. You can deal with a single tap through the charts on the iOS app. Also, the application has over sixty pre-installed technical indicators, allowing us to incorporate intelligent trade tickets.

To Trade or Not to Trade with City Index

City Index is one actual participant in the spread betting business with an experience of more than thirty-four years. The firm provides complete online brokerage services in different CFDs and forex currency pairs with proper regulation and reliable backup.

Also, the brand supports the ever-popular MT4 platform. The broker’s proprietary trading platforms are easy to use, inclusive, and available in different web and mobile formats.

Not only this, with City Index, but you also get tight variable trading spreads, a Reuters news feed, an excellent client support service, and educational tools. Overall, City Index is a manageable and reputable firm for traders of any skill level.

FAQ:

Is City Index Legal?

The online FX/CFD brokerage has a good background in terms of legitimacy. City Index is regulated and licensed in the United Kingdom, and the firm belongs to a company enlisted on NYSE.

According to City Index’s official site, it has over thirty-five years of experience in spread betting services.

Also, City Index is an award-winning spread betting service provider.

The firm was awarded the “Best Pro Trading Platform” from Online Personal Wealth Awards in 2020.

Besides, the broker bragged the ADVFN International Financial Awards 2020 Best CFD Provider award.

Considering the above-given facts, we can say that Index is a legal firm indeed.

Is City Index a Quality Broker?

Below you may find the comments of the Forex traders on the City Index broker:

- Some City Index clients say that they have been using the broker for years and have not encountered any problem while withdrawing.

- Few others said above the speediness of the withdrawals.

- Some traders even said that they do not understand so much negativity for the broker.

Based on the above trader comments, you can decide whether or not the City Index is a quality broker.

What is the Minimum Deposit on City Index?

The firm suggests a minimum deposit of GBP 100, although the traders should have enough deposits to meet their margin requirements.

Is City Index Authorized?

The firm belongs to GAIN Capital UK Limited with a license from the FCA (113942). The FCA license makes the broker a MiFID-compliant. City Index, with the registration number 1761813, is registered in the UK. As already mentioned, GAIN capital is listed on the NYSE.

Where is City Index Located?

The broker has headquarters in the UK. The exact location of the City Index is Park House, 16 Finsbury Circus, London, EC2M 7EB.