AvaTrade is a multi-national corporation with administrative headquarters in Dublin, Ireland. The company also has sales centers and regional offices in Dublin, Milan, Tokyo, and Sydney.

You may have a look at their official website at www.avatrade.com. We have attached a screenshot of AvaTrade’s website’s homepage below.

AvaTrade – Regulation & Licensing

The AVA Trade EU Ltd is regulated by the Central Bank of Ireland with reference number C53877 and is incorporated in Ireland. The company is a licensed investment firm compliant with the Markets in Financial Instruments Directive (MiFID).

The MiFID operates inside Europe and regulates the investment service companies there. Also, the primary function of MiFID is to improve operating efficiency and transparency in terms of finances. The firm likewise offers better consumer protection for all the clients of the investment companies.

AvaTrade has observed exponential growth over the past few years. Surprisingly, the firm has over twenty thousand global customers who perform two million monthly transactions. Altogether, the monthly Forex trading volume is over US$60 billion, and AvaTrade has received nine awards worldwide since 2009.

Background Information

AvaTrade stands out from all the similar Forex brokers because of its financial backup system and user-friendly approach. The broker offers numerous trading platforms to its clients.

Moreover, the clients can clear their queries 24 hours a day and in the language of their own choice. Also, AvaTrade brings a wide range of educational tools to guide traders of every level. Besides that, the AvaTrade traders also access various trading assets like Equities, Currency Pairs, Commodities, and Indices.

Either you are a rookie trader or an experienced one. AvaTrade has versatile trading platforms and brokerage services that balance accessibility and innovative functionality.

AvaTrade’s trading platform is fully functional and integrated, which enables traders to access multiple asset markets. For instance, traders can execute all transactions in CFDs, ETFs, Commodities, Indices, and Equities from one single platform.

Where possible, AvaTrade gives leverage of 400:1. The platform offers two basic accounts: A Forex demo trading account and a live funded trading account.

With demo accounts, you can trade using $100,000 of virtual money that expires in twenty-one days.

The benefit of demo accounts is that the traders are well-informed and get full practice before trading. So before you switch to a live funded account, try the demo account.

Deposit and Withdrawals

To open an account via AvaTrade, the credit card depositors will require at least $100 as an initial deposit. In contrast, those depositing from wire transfer must make an initial deposit of $500. You can deposit to your account via Bank Wire Transfer and credit cards like VISA, MasterCard, POLi, JCB, etc.

Moreover, clients worldwide, except in Australia and the EU, can make electronic payments via Skrill, PayPal, Neteller, and Webmoney. The client support of AvaTrade confirmed that clients could make a minimum deposit of $100 using PayPal.

If you want to begin trading instantly, using a MasterCard or VISA credit card is the quickest way to fund your trading account. All you need to do is select my account, click the deposit, and add the required details.

The requirements include a color scan or picture of a valid national identity card and an exact copy of a utility bill from the past two months (water or electric bill, bank statement including your complete name and address, etc.).

Furthermore, you must give a clear picture or scan of your credit/debit card, showing all four corners. The image must clearly show your name, credit/debit card expiry date, and the first four and the last four digits of your plastic card. The firm asks for all these requirements to fulfill anti-money laundering laws.

AvaTrade Forex Welcome Bonus

AvaTrade gives a bonus to newly registered traders. They get a signup bonus of 40% up to $10,000 of the first deposit amount. It will be added to your initial purchase on the site. Also, look at all the requirements you need to meet for withdrawing after utilizing the bonus.

To withdraw the amount, log in to your AvaTrade account and click the “My Account” option in the upper right corner of the website. Then, depending on the instructions, fill in the withdrawal form carefully. After completing the information, click the upload documents on my account page and submit the form.

Note that withdrawals may take one to two days to remove the funds from your account. Similarly, it will take around five working days to enter the receiver’s account. Remember that Saturday and Sunday are not AvaTrade’s working days.

Tools and Trading Platforms

AvaTrade supports a wide range of trading platforms. The AvaTrader trading platform on the brokerage’s client-side operates on Windows XP, Vista, Windows 7, and a Mac version. All these can be easily installed and downloaded directly to your desktop and laptop.

The screenshot below depicts the full functionality of AvaTrader, including fundamental analysis, technical analysis, tutorials, reports, account management features, etc.

Moreover, using the AvaOptions Web platform and the MT4 WebTrader, you can sign into your AvaTrade trading account from any internet browser without having to install them.

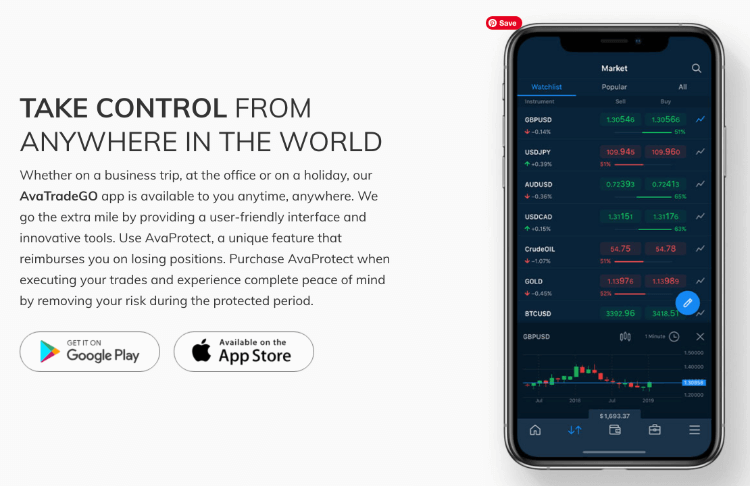

In addition, there is an AvaTradeGo application that you can install on your iPad, iPhone, and Android phones. You can download it within seconds and trade via your AvaTrade. Also, using the application, you can easily manage and view your AvaTrade account.

Along with AvaTrade’s trading platforms, the firm supports other platforms like MetaTrader 4, MetaTrader 5, DupliTrader, and ZuluTrade. If you already use MetaTrader 4, AvaTrade allows you to get their version of the popular forex trading software for a more straightforward account installation.

AvaTrade’s Asset Categories

AvaTrade allows FX trading for over fifty currency pairs. The maximum the firm provides on the currencies is a ratio of 1:30.

Using CFDs, the broker also allows trading Stocks, Bonds, ETFs, and Commodities. There is a fascinating range of Indices, Stocks, Energies, Precious Metals, and Agricultural Commodities on AvaTrade.

However, cryptocurrency is the main attraction in the broker’s selection of tradable assets. Through CFDs, traders can trade Bitcoin, Gold, Bitcoin Cash, Ethereum, Litecoin, Stellar, and XRP. Generally, traders cannot buy actual cryptocurrencies via the broker.

Trade Commissions and Fees of AvaTrade

You don’t have to pay to open an account on AvaTrade. Although, you will have to entail fees for the broker’s services using many other channels.

- The spreads are calculated from the secondary currency, the second currency in the pair. After calculation, the spreads are multiplied by the trade size.

- Additional fees are based on maturity rollover, overnight interest (interest-free accounts do not charge these fees), and other corporate actions. Note that you will be charged an inactivity fee.

Research and Education

Avatrade has a trading academy known as SharpTrader. It brings a complete guide for beginners in trading. Also, it offers order types and economic indicators of trading. Many interactive video tutorials on the platform will explain the best trading tools and strategies.

One fantastic educational offer on the broker’s site is that of eBooks. You can get access to these detailed eBooks by registering manually.

Trader Support

AvaTrade has friendly and user-oriented customer support available. The broker offers client services twenty-four hours daily (Excluding Saturday and Sunday). You may reach the trader support team via email, live chat, fax, or contact number. Additionally, AvaTraders support agents give services in multiple languages among different regions for the client’s ease.

Moreover, traders new to the Forex market can use different educational guides on AvaTrade. The informative guides are trading tutorial videos, eBooks, webinars, written instructions for new traders, etc.

AvaTrade Mobile Trading App

AvaTrade brings trading options for mobile users. One is the AvaTradeGo application, available for Android and iOS users. The app includes trading behavior features, live charts, prices, and watch lists for traders.

The second mobile option is the MetaTrader 4 platform mobile version. It is also available for both Android and iOS users. The application brings a full-featured platform for phones and tablets.

To Trade or Not to Trade with AvaTrade

To sum up, AvaTrade brings the most remarkable full-fledged online brokerage service. The firm’s traders can execute transactions in equities, commodities, indexes, CFDs, and ETFs. The platforms support MT4 and bring a simple proprietary AvaTrade trading platform for the clients in web, desktop, and mobile versions.

Furthermore, there is a generous 40% bonus for the traders on the initial deposit. The traders can access it via any payment method, including PayPal. The brokerage’s maximum leverage is 400:1. Although AvaTrade offers low leverage compared to others, it is safer for novice traders.

FAQ:

What way can I use for depositing funds at AvaTrade?

Well, you can deposit your funds using different methods. It can be through credit cards (VISA, MasterCard, debit card), wire transfers, and e-wallets like Paypal, Skrill, NETELLER, and WebMoney.

Is AvaTrade Regulated?

Yes, the firm is regulated worldwide.

The Central Bank of Ireland is regulating AVA Trade EU Ltd.

ASIC is regulating Ava Capital Markets Australia Pty Ltd.

The South African Financial Sector Conduct Authority (FSCA) regulates Ava Capital Markets Pty.

In Japan, FSA (1662) and the FFAJ (1574) regulate Ava Trade Japan KK.

How much time does it take to withdraw from AvaTrade?

You can withdraw from AvaTrade within one day. Depending on the withdrawal methods, the time of withdrawals may vary.

Credit or debit card withdrawals take up to five working days.

E-wallet withdrawals take one day.

The bank wire transfers take around ten business days. The delay here is dependent upon the Country and bank in question.