CMC Markets is one of the biggest brokers in the financial trading world. It provides its services to the traders with regulations in Australia, the UK, NZ, Singapore, and Canada.

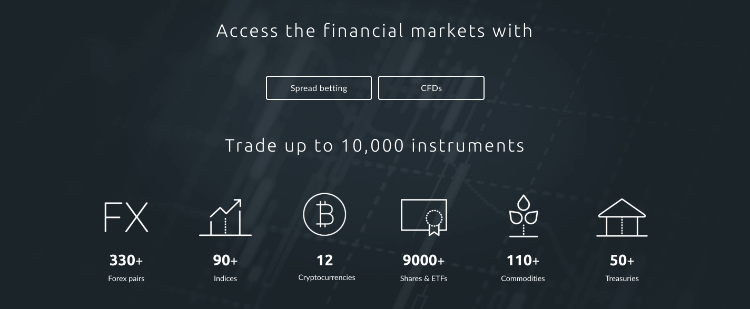

CMC offers CFD trading in all the global markets, while in Australia, stockbroking is also provided by CMC. The additional service provided by the CMC Markets in the UK is spread betting.

CMC Markets forex traders can choose between MT4 and the Next Generation CFD Platform. A different stockbroking platform is needed if you wish to trade shares in Australia.

CMC Markets Trading Accounts

There are three (country-based) accounts available with CMC markets for trading. The CFD account is the most famous CMC account, which can be opened anywhere in the world (not only in restricted areas like the USA). Stockbroking can only be done in Australia, while spread betting can only be done in the UK, offering some tax benefits.

There are specific trading platforms for every type of account. For instance, if a trader in Australia wants to trade CFDs and shares, they have to use two different platforms.

Spreads and Fees

Other than shares, there is no commission on the trade of CFDs. However, the average spreads of the broker are not published by them; instead, they feature their minimum spreads so that the brokers’ comparison could be challenging.

The broker published the following minimum spreads:

- Indices spread from 1.0

- Forex trading spreads from 0.7

- Commodities spread from 0.3

- Cryptocurrencies spread from 1.4

- 0.10% commission on CFD shares.

- Treasuries spread from 2.0

And the costs of trading with CMC markets are:

- Market data fees.

- The holding cost.

- Inactivity fee (monthly).

- Stop-loss charges.

How CMC Markets Fees Compare

It isn’t easy to calculate the brokerage’s exact cost for spread betting or CFDs because they do not provide their average spreads in the CMC markets.

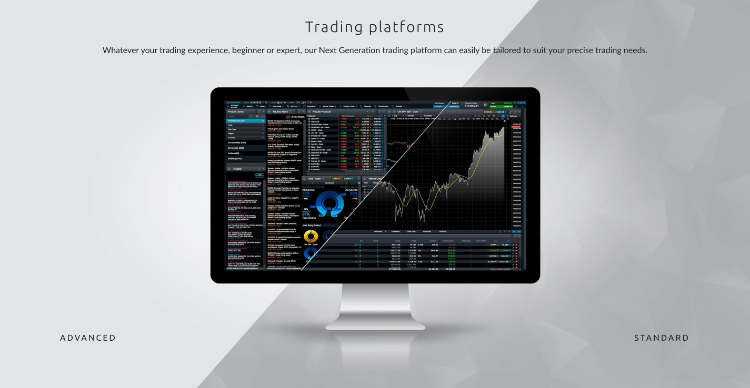

Types of Trading Platforms

CMC market offers three platforms for CFD trading:

- Next-Generation Standard.

- Next-Generation Advanced.

- MT4 (MetaTrader4)

Next-Generation Platforms (Standard + Advanced)

The CMC, known as the Next-Generation platform, offers primary software for CFD trading.

The charting package is the best feature of this platform, including 70 chart patterns, 115+ technical indicators, and 12 built-in chart types. Traders can do price movement analysis and detailed technical analysis. This platform won the 2019 Investment Trend Survey with the help of this charting package.

This platform offers three tools for trading. Client sentiment is the first tool that determines the position value and quantity of the instrument traded. The second is the multiple layouts that include the 5-minute chart layout to assess the price movement. The third is the pattern recognition scanner that identifies any change in the patterns and then alerts them.

It is available on:

- Desktop platform (usually a download is required)

- Mobile trading apps (built for iOS and Android smartphones)

- Web-based trading platform.

The CMC market review revealed that the CFD trading mobile app works like the desktop platform. Traders can access the CMC market’s complex order and account types, trading instruments, screeners, account details, and charting from the iPhone or Android apps.

This app is so intelligent that the traders can customize the layout according to their wish and what they want to have on the screen when he opens the app.

The iPhone app has a fingerprint security option, but Android doesn’t have that option. Though they have added the fingerprint feature in the iPhone app, there is no additional security other than a login password.

There should be additional security features like login verification from different devices and automatic sign-out. Plenty of traders invest a large amount of money, and it isn’t enjoyable to have a security feature like this.

Multiple news and information sources are coordinated into the next generation. You can find it in the insight section and Morningstar research reports that make fair estimates of the market, CMC TV, where experts will be discussing the technical analysis of the market, and Reuters news.

CMC’s Twitter feed and the market calendar are available in the insight section.

Only the MetaTrader4 Trade Platform is Available Currently

MT4 is the most popular platform worldwide, and CMC markets offer this platform too. The EA’s automated trading ability, technical analysis, social trading, and user-friendly interface are the main reasons for the popularity of MT4.

It also provides advanced trading strategies from pattern recognition to an economic calendar. The advanced drawing tools and chart types offer an extra market overview, such as customer sentiment. This platform will provide demo and live accounts to test your trading abilities in limited conditions.

As CMC offers MT4, you can have only limited functionalities and instruments on the forex platform. Selecting a Next-Generation account to trade with CMC is recommended, but if you are interested in using MT4, then view the broker page for the best MT4.

CMC platform is ranked second to the last in leading brokerages because it only offers one platform.

Comparing CMC with Pepperstone, which was voted the broker with the best forex platform, it offers seven different platforms, including MT5 and cTrader. It clarifies that the clients want to have multiple reputable platforms rather than homemade ones.

Trader Support

The global support offered by CMC markets is 24/5 and has the following three channels:

- Email Support

- Phone Support

- Live-Chat

And the support is available in 9 different languages. The CMC markets’ main office is based on CMC Markets UK Plc and is located at 133 Houndsditch, London.

Minimum Deposit to Open a Real Account

Some forex brokers like Price Markets, Vantage, and SwissQuote have high minimum deposit requirements. For instance, a minimum deposit of US$1,000 is required by Swissquote. At the same time, the industry standard for the minimum deposit requirement is US$200, and CMC has a $0 minimum deposit requirement for a demo account.

Zero minimum deposits can only be significant if:

- You can open an account with CMC and want to know more about its features before you invest your money.

- You may want to try the demo account.

- You want to trade with as low capital as possible.

Even if you have opted for the no minimum deposit account, you still need some money to meet the trade margin requirements.

Funding Methods

You can enjoy multiple funding methods like Debit/Credit Cards, PayPal, Bank Wire transfers, and electronic wallets. There is no deposit for any payment method, but an inactivity charge is due when you don’t use your account for a month. The withdrawals are made through the deposit methods without any fees.

CFDs and Forex Pairs

The CFD account offers many instruments to trade, from ETFs to Bitcoin. Stockbroking is being provided in Australia, while spread betting is presented to the clients in the UK. You can do all this on the cmcmarkets.com website, which also has subfolders depending on the country’s location.

CMC Markets Leverages

The country or region-specific regulations determine the maximum allowable leverage a broker can offer.

In our research, we found that the maximum leverage level permitted by ASIC in Australia is 500:1. However, firms like OANDA offer only 100:1. And The leverage rate possessed by CMC Markets is 500:1.

You can also find this rate on the other forex brokers, but it is highly competitive if the other CMC features are combined. CMC Markets use FCA for the United Kingdom and Europe. The leverage for the major currency pairs like JPY/USD, EUR/USD, and AUD/USD are 30:1, and the margin is 3.3%.

For exotic and minor pairs like GBP/JPY, EUR/GBP, and EUR/AUD, the leverage is 20:1. These are the maximum levels permitted by FCA and are competitive with other UK forex brokers.

Leverage trading or trading on margin means you can profit if the market moves in your favor. The substantial risk of leverage trading is that it can increase your losses significantly if the market doesn’t move in your favor.

Traders can maximize their return of low capital employed using the high forex leverage levels or high margin.

For example, a strategy of 500:1 forex leverage implemented at work means if you have underlying equity of $200, you will be provided with $100,000 worth of funds to trade currency.

The losses or gains would be amplified with the change in currency pairs, which is considered a critical issue. You can understand it by comparing the forex brokers we provided, and they also offer the same leverage for CFDs.

Guaranteed Stop Losses

The brokers in Australia need to help traders manage their risk on investments and offer high leverages. Guaranteed Stop Losses provided by CMC Markets are the best way to protect traders’ assets from huge losses.

You pay for this protection for a small amount and guarantee you will not lose more than your estimated loss for a specific trade. The broker will absorb the gap if the prices fall below the level of your loss tolerance.

Trailing stop-loss is another helpful feature that CMC Markets are offering. It will ensure that the stopgaps are moved along the currency pairs in the predicted direction, leading to profits. Stop-loss will start its work to make the price more favorable when the currency moves against the expected direction.

CMC Markets Regulation and Licensing

Following are the regulations of CMC markets around the world:

ASIC – ASIC has registered CMC Markets Asia Pacific Pty Ltd with the registration number AFSL 238054. It is located at 300 Barangaroo Avenue, Sydney, Australia.

FCA – FCA has registered to CMC Spreadbet plc and CMC Markets UK plc with registration numbers 170627 and 173730. The broker’s location is at 133, Houndsditch, London, UK.

MAS – MAS regulates the CMC Markets Singapore Pte LTD with the registration number 200605050E. The location of the broker is CMC Singapore 9 Raffles Place, Singapore.

IIROC – CMC Markets Canada Inc has a membership of IIROC, located at 100 Adelaide St. West, Toronto, Ontario.

FMA – The New Zealand company registration number of CMC Markets NZ Ltd is 1705324. They are located at 151 Queen Street, Auckland, New Zealand.

The trading experience rules for each regulator differ from leverage; instruments offered are based upon the treatment of segregated bank accounts. So, an individual must understand the conditions imposed on a sophisticated tool like CFDs by each regulator.

To Trade or Not to Trade with CMC Markets

According to our CMC, Markets is the top forex broker for intermediate traders, and it is because it offers a stable platform for trading, high leverage, and guaranteed stop-losses.

It could also be due to the company’s experience because it was founded in 1989. The accumulated knowledge of CMC Markets gives assurance to the traders. You shouldn’t select your broker based on experience only, but it is one of the definite trust signs.

CMC Markets getting higher votes in comparing best forex brokers provides marginally lower spreads, noticeable if you start day-trading or adopt automatic trading techniques.

Pepperstone and IC Markets also saw improvement in the execution speed, and they were able to reduce issues like slippage.

The lack of platform diversity and average security concerns the potential clients that, might lead to clients’ loss.

Overall, traders who are looking for high leverage should consider this broker. And they should do everything to reduce the risk factor because CFDs and Forex are risky asset classes.

FAQ:

Are CMC Markets good?

They are a perfect fit for the low-skilled and new traders because they offer helpful educational resources, free live accounts, and average-to-competitive spreads.

Does CMC Markets broker allow scalping?

CMC Markets allows hedging and scalping, risk management tools, trading features, and funding methods. EAs can be traded on IG but not with CMC Markets.

Is CMC Markets a market maker?

The country’s biggest suppliers, IG Markets and CMC Markets, are the most significant market makers, and direct market services are also offered to customers by CMC Markets. The second model has no linkage between the CFDs sold and the trade, and there can be deviations in the hedging volumes.

Risk Disclaimer: CFDs are complex instruments, and high risk is involved with the leverage while trading CFDs. CMC Markets UK posted that in June 2020, 78% of retail investor accounts went through a loss when traded on their retail investor accounts.

It would help if you considered the consequences of not having enough knowledge about the risk of trading CFDs. Before opening a CFD broker or CMC Markets account, you should gather all this information and understand if spread betting and CFD are the right choices for you.