eToro was founded in 2007 with the sole purpose of making a financial investment platform for all. It is situated in Tel Aviv, Isreal, and was started by two brothers named Yoni, Ronen Assia, and David Ring.

The organization has over 15 million users from more than 170 countries. People employ eToro to trade Cryptocurrencies, Stocks, Commodities, and Currencies.

Attracting thousands of new traders daily via online trading circles and investment platforms, eToro enjoys the position of one of the world’s dominating investment channels.

eToro UK – Background Information

Regarding the laws and regulations, eToro is CIF registered with reg# HE200585, and CySEC regulates it under license# 109/10. Its headquarters are based in Limassol, Cyprus.

The organization has an official website at www.etoro.com.

eToro is also situated in the United Kingdom. The headquarters of eToro (UK) Limited are centered in London with reg# 7973792, and FCA regulates it under ref# 583263. eToro (UK) Limited as well as eToro (Europe) Limited act per the Markets in Financial Instruments Directive (MiFID).

In the US, Tradonomi LLC regulates eToro USA. Presently, eToro allows actual Crypto, not CFDs, to enable you to buy without leverage. In the current year (2020), real stocks will be offered for trade and require a minimum deposit of 50 USD in the United States.

Presently, eToro is accessible in the following states:

Massachusetts, Indiana, Missouri, Ohio, Georgia, Iowa, Mississippi, Maryland, Michigan, Colorado, New Jersey, South Carolina, Washington, Virginia, Arizona, Pennsylvania, Utah, Wisconsin, North Dakota, South Dakota, Arkansas, Oregon, Vermont, Alabama, Maine, Oklahoma, Rhode Island, Kentucky, Montana, Wyoming, California, Alaska, New Mexico, Kansas, Connecticut, Washington DC, Florida, Texas, Idaho can deposit, and two territories Northern Marianas & US Minor Is.

Australia also regulates and registers eToro. eToro AUS Capital Pty Ltd has an ASIC license with AFSL no. 491139.

Broker Attributes

One of the most captivating and noticeable characteristics of eToro, other than educational initiatives and online trading platforms, is its online financial trading circle.

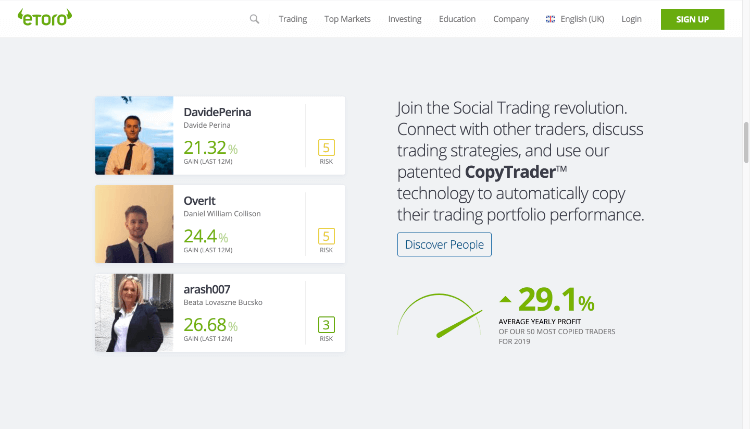

Without a doubt, eToro is one of the world’s largest trading communities. Being the chief of social trading channels, eToro is the first in its field by tools, i.e., CopyTrader and InvestorFinder. These tools aid the traders in taking benefit from the techniques of top-notch professionals.

The traders can take advantage of the combined hard work of top-notch traders through the prize-winning social investment channel. Traders can benefit by acquiring knowledge from, socializing with, and imitating the trades of fellows in actual time.

Social Trading

With the help of social trading characteristics, traders can watch real-time feeds of trading, looking at what fellow traders are doing as the market oscillates. With the help of the InvestorFinder tool, a broad range of traders is traced, enabling the users to opt for a specific trader(s) using the “Follow” instruction.

After opting for the traders using the InvestorFinder tool, the user can allocate a particular percentage of funds for imitating the trader(s). CopyTader tool is activated by pressing the “Copy” command. This tool will copy the chosen trader’s transactions in an automated manner in real-time and carry out the trade in the user’s account.

Besides imitating the trades of investors, users of eToro can also socialize with traders, even those they are following and replicating via a social channel.

It allows the traders to become “Popular investors” by permitting other traders to copy trades and acquire prizes for enrolling copiers. Depending upon the payment eligibility, victorious Popular Investors get payments every month.

EToro charges no commissions for trading. However, as compensation, it depends a bit on broader spreads on every trade.

Usually, on eToro, trader spreads start from two pips and three pips for the USD/JPY, EUR/USD, USD/CHF, USD/CAD, and USD/RUB, respectively, excluding the Bitcoins transactions that charge one pip for one transaction. The lesser currency traded pairs possess spreads as broad as 14 pips.

Etoro has shifted from trading stocks from CFDs to real since April 29th, 2018. Every county will be trading actual stock except for the ones listed below. These will remain CFDs:

Afghanistan, Angola, Australia, Congo, Myanmar, Liberia, Libya, Nauru, New Zealand, Nigeria, Sierra Leone, Zimbabwe, Cote d’Ivoire, Belarus, Macedonia, and Iraq.

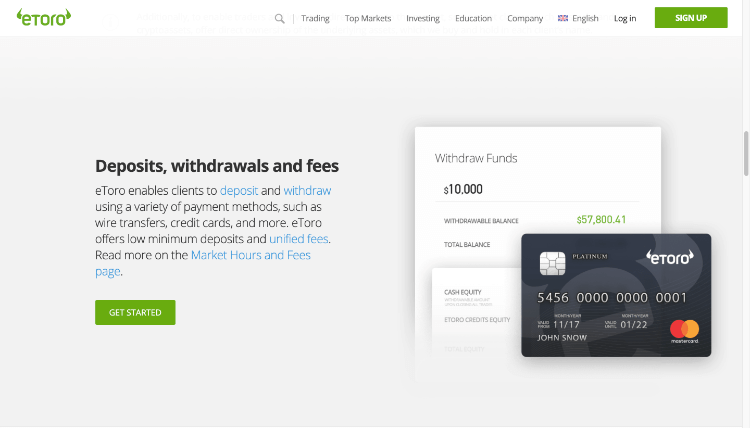

Depositing and Withdrawing at eToro

eToro trades in US Dollars; hence, deposits in any other currency are converted to US Dollars after receiving them. For opening an eToro live account, the minimum deposit ranges between 200-1,000 dollars.

However, Israelis have to deposit a minimum of 10,000 dollars. Credit cards such as VISA, MasterCard, Diner’s Club, and AMEX can deposit money. Also, Paypal, Skrill, Neteller, China Union Pay, Yandex Money, Giropay, Paymaster, etc., can be used for electronic wallet deposits.

The minimum and maximum deposits are based on the type of procedure used. At least 200 to 1,000 5,000 US Dollars are required for Paypal, Credit Cards, and Skrill deposits.

Neteller needs a minimum of 200 to 1,000 dollars and a maximum of 10,000 US Dollars. And for WebMoney and Giropay deposits, a minimum of 200 to 1,000 dollars and a maximum of 50,000 US Dollars are required. Deposits can also be made using bank wires with a minimum of 500 dollars.

There is a need to fill out a withdrawal form in the website’s Cashier portion for withdrawing cash. This form can be obtained by pressing the tab “Withdrawal,” eToro will notify the user through an email.

First-time withdrawals require the user’s passport copy, signature, and a copy of utility bills maximum of three months old. In case of any deposit made through a credit card, a replica of both sides should also be provided.

EToro charges a fee of 5 dollars for withdrawing the amount, and its processing takes 24 to 48 hours.

eToro Trading Platform and Tools

An online financial trading platform developed by eToro that includes a graphical/visual trade environment presented as a competition among currencies is available in a downloadable program.

The organization also possesses an “Expert Mode” application for trade. Also, it has an online trading platform named “Web Trader.” Following is a snapshot of the software:

Users are also offered a mobile application that is available for iOS as well as Android phones. These mobile apps can be installed from Google Play and App Store. EToro trades in US Dollars because they require a uniform currency to ensure transparency on their worldwide channel.

The significant element in operation is Copy Trading. This strategy also offers a Copy People screen that caters to traders with different methods for locating traders parallel to their trading style needs.

The Popular Investor Program is present in the Popular Investor portion. With the help of this, the traders being copied are rewarded by dealers, hence providing them another method for gaining monetary benefits from their trading skills. Everybody can be a Popular Investor.

A brilliant feature of the eToro platform is the Social Newsfeed that allows the traders to socialize, discuss, and stick to the steps of their fellows, etc.

Whenever a copied trader takes action or posts anything, the users are notified via web platforms and mobile.

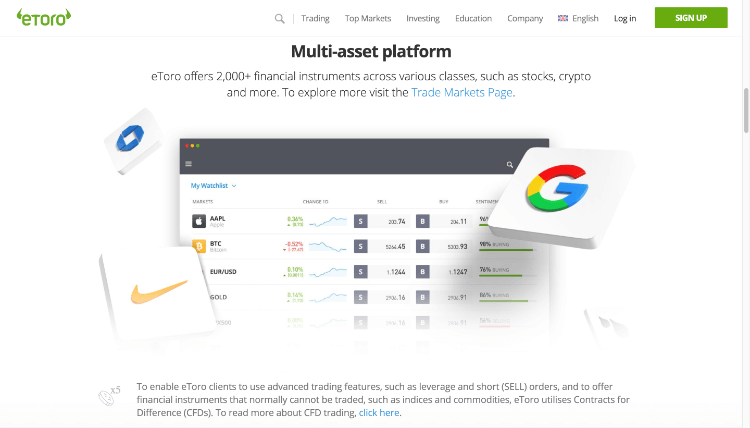

Assets Portfolio

eToro covers a brilliant portion of the market. Every prime asset class one may anticipate from a top-notch dealer lies under eToro’s umbrella. It includes Crypto Assets, ETFs, Stocks, Commodities, and a vast Currency Pairs selection.

In stocks, their trading can be done directly (purchasing them and waiting for the prices to get high) or by CFDs, in which traders can gain money when the stock price falls by Shorting it.

Usually, most dealers allow the trade of crypto assets via CFDs. However, eToro supports buying and holding cryptocurrencies like Ethereum and Bitcoin on behalf of the user, making the crypto assets trade a reality. Such trades are unleveraged.

The ones under the umbrella of ASIC regulation can only trade digital assets via CFDs.

Trade of commodities is practicable only via derivatives, and the same is the case with currency pairs in eToro. The dealer does not require direct engagement with the FX section.

The choice of Indices and ETFs is quite fair. For many traders, trading these asset classes via CFDs is very convenient and straightforward.

Commissions and Fees in the UK

EToro charges no commission, and it gains money via the spreads.

The costs that the traders will experience are confined to withdrawals as well as a rollover. Additionally, these unexpected charges depend on assets and leverage; it also charges an inactivity fee of 10 US Dollars per 12 months.

Research and Education

The educational portion of the dealer seems astonishingly brief. It also offers a log, a “Complete Guide to Fintech,” and a Daily Market Review portion.

The blog comprises casual but helpful posts regarding different markets and economic happenings. The Fintech Guide is accessible free of charge to every new entrant and is an electronic book. It teaches traders the intricate details of trading different asset categories and offers techniques and tips for creating an investment portfolio.

However, it’s all right to suppose that most of the education acquired by the traders via the platform is provided with the help of the social section of the platform.

Client Support

The client support team of eToro is accessible 24/5 through chat and email. eToro offers email support services to its registered clients and not registered clients. The support team usually responds typically 48 hours.

eToro App and Mobile Trading

The mobile application of eToro is available for iOS and Android, with full functionality.

Most traders that trade via a mobile application acknowledge its abilities and performance. The Android version offers all social trading features and allows traders to participate in the active crypto community.

The iOS version is almost the same as the Android one. Presently, it has a 3.4/5 App Store score.

These applications are updated regularly and are accessible in specific languages.

To Trade or Not to Trade with eToro

Convenient and straightforward trading platforms are offered by eToro, having distinctive characteristics capable of making trading more exciting and enjoyable.

FAQ:

Is eToro legal?

eToro is legal trading and a well-known and appreciated social trading platform.

It allows the trading of cryptocurrencies, commodities, stocks, and currencies and grants the users zero-commission access to shares.

It refers to itself as the “World’s dominating social trading and investment platform,” which is correct. Its marketing unit has dramatically increased its legitimacy via renowned spokespeople like Alec Baldwin.

Is eToro a quality dealer?

The most exceptional measure of a dealer’s fame is its image among its clients. It’s a very delicate matter for the majority of the dealers due to the given reasons:

- Traders with a feeling of insignificance are inclined more towards giving reviews and complaints in public.

- Scammers usually use feedback portals to promote their unreliable services.

- Amateur traders are possibly disadvantaged for a more extended period. Thus, excessive negative reviews compel them to leave.

All these problems are prevalent in eToro. It is barely a fair and satisfactory dealer if we judge it entirely on users’ reviews, and most clients consider it appalling and fraudulent.

The following are several complaints:

- Dishonest market making.

- Prolonged withdrawals

- Massive commissions and withdrawal fee

- Spreads manipulation

- Profit canceling

- Account blocking without reasons.

What is a minimal deposit for eToro?

The minimal deposit amount for eToro relies upon your relocation and deposit procedure.

- The minimum deposit for residents of Australia or the United States is 50 dollars.

- For every other trader, the minimal deposit for 1st time is 200 dollars.

- The minimum on succeeding deposits is 50 dollars.

- The minimum deposit amount for registering a real trading account is 500 US Dollars if depositing through a wire transfer.

Is eToro Regulated?

eToro is regulated and possesses a unique regulatory profile.

- FCA grants eToro UK Limited a license, and its license # is FRN 583263.

- CySEC licenses EToro Europe Limited under license# 109/10.

- In Australia, eToro AUS Capital Pty Ltd. is licensed by ASIC with license # AFSL 491139.

Where is eToro located?

eToro manages many offices all over the globe.

- The United States branch operates at 221 River Street, ninth floor, Hoboken, NJ 07030, USA.

- In the UK, its branch is located on the twenty-fourth floor, One Canada Square, Canary Wharf London, E14 5AB, UK.

- In Australia, eToro AUS Capital Pty Ltd is at Level 33, Australia Square, 264 George St., Sydney NSW 2000, Australia.

- EToro Europe is at 4 Profiti Elia St., Kanika International Business Center (KIBC), seventh floor, Germasogeia 4046, Limassol, Cyprus.

Risk Warning:

eToro is a platform with a combination of asset classes, offering investment in stocks & cryptocurrencies and CFD asset trade.

It should be noted that CFDs are complicated tools and possess a vast monetary risk because of leverage. While trading with eToro, 66 percent of investors suffer a financial loss. You must consider if you comprehend the working of CFD and if you can take higher monetary risks.

Cryptocurrencies are volatile and unregulated investment goods—no protection for EU investors.

Past performance does not guarantee future outcomes. The given trading history is less than five years and might not be enough for making any investment decision.